Synthetic Biology: market drivers, challenges and R&D oppo...

Synthetic biology (or SynBio) is an exciting intersection of biology and engineering, which promi...

R&D Tax Relief is an HMRC incentive for businesses that invest in research and development – aiding the advancement of knowledge and economic productivity across the UK.

Understanding how much tax relief you’re eligible for may seem complex, especially when tax relief rates are changing with the government reforming how much you’re able to claim. In this blog we explain the fundamentals of how to calculate R&D Tax Credit benefits, with tax credit rates for pre and post-April 2023 expenditure.

Your R&D Tax Credits estimate will depend on whether you use the SME R&D Relief scheme or Research & Development Expenditure Credit (RDEC). Essentially, the SME scheme is for businesses that employ fewer than 500 staff and have a turnover of under €100m (or €86m net assets) while RDEC is for large businesses or subcontracted companies that carry out R&D. You can find out more by reading our article on The Differences Between The SME & RDEC R&D Tax Credit Schemes.

SME R&D Relief helps businesses reduce their taxable profits. HMRC allows businesses to deduct an extra 130% on qualifying R&D expenditure costs from the annual profits on their corporation tax bill.

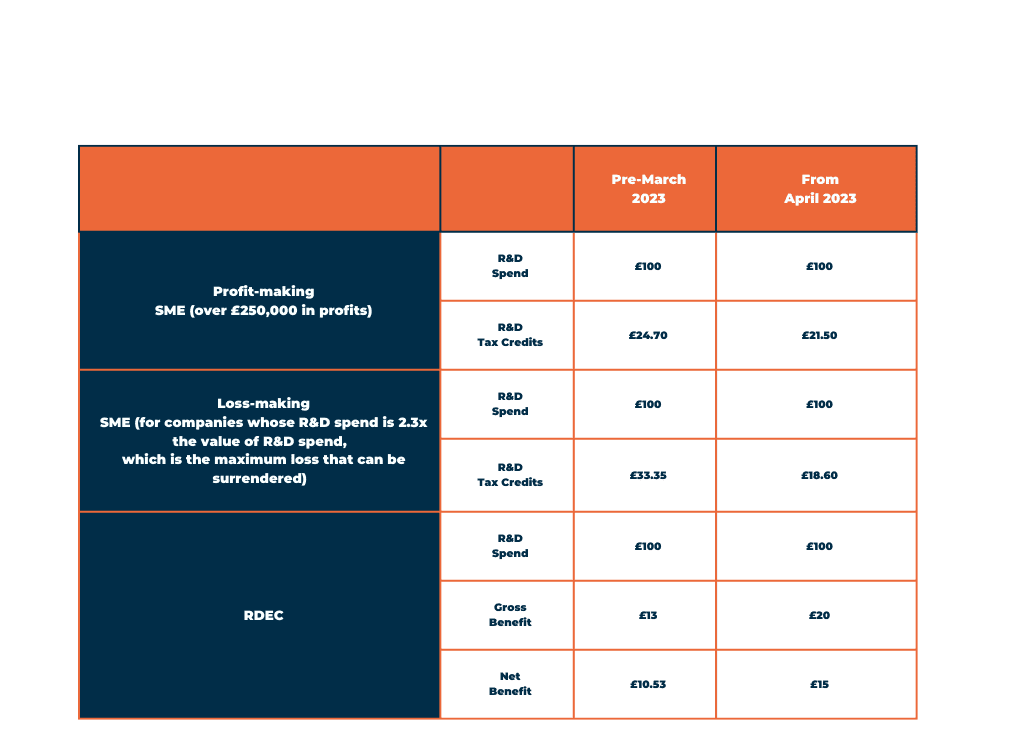

This means profitable companies can claim up to 24.70p of every £1 spent on R&D activities, allowing your business to increase investment in R&D further.

For example, if you have spent £100 on qualifying R&D your additional enhancement would uplift this to an extra £130. Corporation tax in the UK is currently 19%, meaning that you would receive an extra £24.70 through R&D Tax Credits.

SME R&D Relief also helps loss-making companies, who can surrender their losses in exchange for a cash payment worth £33.35, based on a credit rate of 14.5%.

Loss-making businesses can claim 230% of their qualifying R&D expenditure. For example, for £100 spent on R&D costs you’d get an extra £130 uplift, resulting in £230 of enhanced expenditure. When the 14.5% credit is applied to this enhanced expenditure you’d receive £33.35 through R&D Tax Credits.

For expenditure from 1st April 2023, the additional deduction for SMEs will decrease from 130% to 86%, and the SME credit rate will reduce from 14.5% to 10%. On top of this, corporation tax is changing to 25% for all companies with over £250,000 in profits.

Profitable businesses can therefore claim up 21.50p of every £1 spent on R&D Activity. For example, if you spend £100 spend on eligible R&D, your additional uplift would now be £86. If your company pays the 25% corporation tax rate, you’d receive £21.50 through R&D Tax Credits.

Loss-making businesses will be able to claim 186% of qualifying R&D expenditure. The 10% credit rate will result in £18.60 of R&D Tax Credits for every £100 spent.

For RDEC claims, the tax credit itself is taxable as trading income. Regardless of whether you are profitable or making a loss, it reduces your corporation tax liability.

Large companies, or SMEs using the RDEC scheme, can claim 13% back in tax relief on qualifying R&D expenditure. This means that for every £100 you spend on eligible R&D activity, you receive £13 R&D Expenditure Credit (provided as a cash payment). As this is taxable, your net benefit would be £10.53.

Find out more about RDEC, including what HMRC classes as qualifying expenditure, by reading our blog RDEC Explained: Everything You Need To Know About The R&D Expenditure Credit Scheme.

For expenditure from 1st April 2023, the Research and Development Expenditure Credit (RDEC) rate will increase from 13% to 20%. So, for every £100 spent on eligible R&D activity, you will receive £20 R&D Expenditure Credit. After tax, this is a net benefit of £15.

The following table shows example estimates for calculating R&D Tax Credits for the SME Relief Scheme and RDEC using the rates for pre-April 2023 expenditure and for expenditure from after April 2023.

R&D Tax Credits are a valuable way of recouping the costs associated with developing innovative products or services. If you would like a quick estimate of what you can claim, use our free R&D Tax Credit calculator.

To reap the full benefits of R&D Tax Credits, it is recommended that you work with an expert R&D Tax Specialist team. They can help you identify your eligible expenditure as well as ensure that your claim is fully compliant with HMRC rules.

11% of UK R&D Tax Relief claims are submitted by Leyton. We’re trusted by our clients to help them unlock the full value of what they’re eligible for. Speak to a specialist today to find out how much your business can claim. Already claiming? Our consultants are highly experienced in uncovering additional value from existing R&D Tax Credit claims. Maximise your R&D Tax Relief.

If you enjoyed reading this article, you may also like our blog on How R&D Tax Credits Are Changing From April 2023.

Explore our latest insights

Synthetic biology (or SynBio) is an exciting intersection of biology and engineering, which promi...

Even in the best of circumstances, we know that it can be challenging to balance a successful car...

Small and Medium-sized enterprises (SMEs)are the lifeblood of innovation in the UK. We’ve dived i...

Full expensing is a first-year allowance that allows businesses to reduce their tax liability and...