Synthetic Biology: market drivers, challenges and R&D oppo...

Synthetic biology (or SynBio) is an exciting intersection of biology and engineering, which promi...

This article answers commonly asked questions on the R&D Expenditure Credit (RDEC) tax relief scheme. It aims to help large corporations (and some SMEs) understand the ins and outs of RDEC accounting for claiming research and development (R&D) tax reliefs.

RDEC is the Research and Development (R&D) Expenditure Credit scheme. In the UK, RDEC allows large companies (and certain SMEs) to claim a cash credit back on qualifying R&D expenditure. It was launched in April 2013 to replace the large company scheme (which eventually ended in April 2016). It and the SME R&D Tax Credits scheme allow businesses to claim significant tax relief for their research and development activities.

The UK Government defines RDEC as:

A stand-alone credit to be brought into account as a receipt in calculating the profits of large companies for research and development expenditure incurred on or after 1 April 2013. Companies with no corporation tax liability will benefit from RDEC either through a cash payment or a reduction of tax or other duties due.

Many businesses claim R&D tax relief through RDEC scheme. According to the UK Government’s R&D Tax Credits Statistics, 60% of the UK’s R&D expenditure came from companies who made RDEC claims in the tax year for 2021/2022.

The RDEC scheme is for large companies who wish to claim Corporation Tax relief on their research and development (R&D) spend. Companies who can’t claim SME R&D Tax Relief usually claim for RDEC because of their size, assets and earnings. If you employ more than 500 people or if you have a turnover of more than €100m and balance sheet that totals more than €86m, your business will be classified as a large company and will therefore seek to claim R&D tax credits through the RDEC scheme. You can find out more by reading our article on SME vs RDEC: What Are The Differences Between The SME & RDEC R&D Tax Credit Schemes?

Despite replacing the large company scheme, RDEC is not just for large businesses. In fact, SMEs are more likely to make RDEC claims. According to UK Government’s statistics for the 2019/2020 tax year, 4,695 claims were from large companies and 6,420 were from SMEs. The most likely circumstance that an SME would claim under RDEC will be if they have been subcontracted to do R&D work by a large company. SMEs can also claim under RDEC if they’ve received a grant or subsidy for R&D activity.

Broadly, RDEC applications come from science, engineering or software firms; however, in practice, many industries are able to claim. Example industries might include:

For expenditure before April 2023, eligible companies receive 13% of their qualifying R&D expenditure and is taxable as trading income. For expenditure from 1 April 2023, the RDEC rate will increase from 13% to 20%. The current Corporation Tax rate is 19%; however, from 1 April 2023 this is rising to 25% for businesses with profits over £250,000.

Currently, businesses can claim RDEC relief up for the last two financial years (or the last two accounting periods if your financial year is different). Don’t worry if your business has already paid your corporation tax bill; when you make an RDEC claim your tax return is amended and HMRC will be able to issue you with a repayment.

From April 2023, companies will need to give HMRC advanced notice of any intention to make a claim within 6 months of the end of the period relating to their claim (companies that have claimed in one of the preceding three periods will be exempt).

RDEC enables loss-making companies to claim a credit worth up to 13% of qualifying research and development expenditure (rising to 20% for expenditure from 1 April 2023). The loss-making credit works similarly as if the business was profitable, so the credit is also treated as taxable income.

There are several costs that qualify under the R&D Expenditure Credit scheme, including:

From April 2023, it will also be possible to claim for cloud computing, licence payments for datasets and data analytics.

You can’t claim for:

You can find out more about R&D by reading our article on R&D Explained: Everything Businesses Need To Know About Research And Development.

To put together an R&D tax relief claim you’ll need to gather relevant information for HMRC. This includes:

If your businesses and R&D activity qualifies for the RDEC scheme, you’ll be able to claim 13% (rising to 20% for expenditure from 1 April 2023) of your eligible R&D expenditure (regardless of whether or not your business is profitable)

To calculate the amount of your R&D Expenditure Credit you’ll need to:

If your businesses and R&D activity qualifies for the RDEC scheme, you’ll be able to claim 13% of your eligible R&D expenditure (regardless of whether or not your business is profitable). To calculate the amount of your R&D Expenditure Credit you’ll need to:

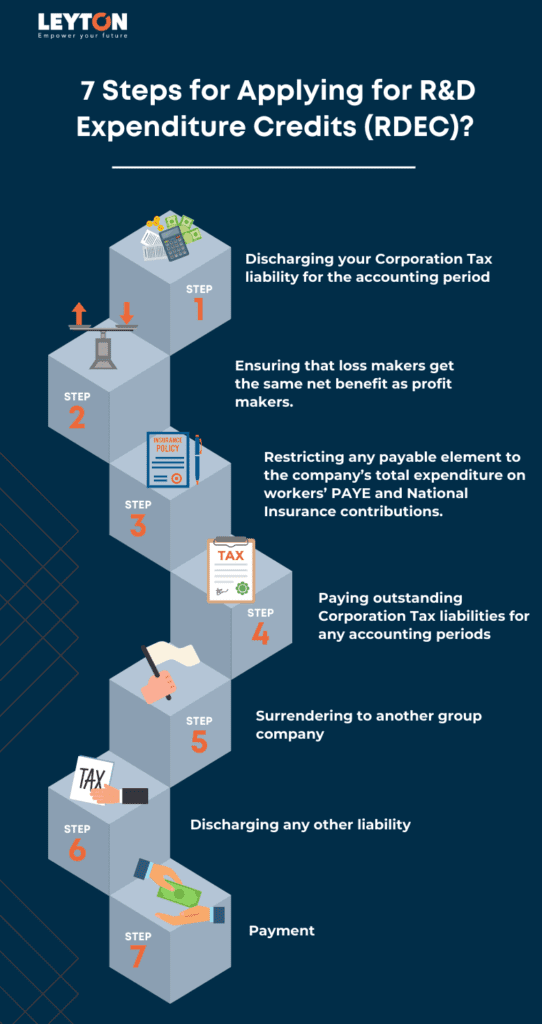

The UK Government lists seven RDEC steps, to work out how the credit claimed should be paid:

The credit needs to settle your Corporation Tax liability for the accounting period (but you will pay Corporation Tax on the credit). If you’re due a repayment on your Corporation Tax because of the credit, the interest will be paid using the Last In, First Out (LIFO) basis.

If you have R&D Expenditure Credit remaining, a notional tax charge must be applied (i.e., Corporation Tax). Currently, the main rate of Corporation Tax is 19% but from 1 April 2023 this is changing to 25% for businesses with profits over £250,000. The notional tax is carried forward and allows you to reduce your Corporation Tax liability for a later accounting period.

Your R&D Expenditure Credit can’t exceed your company’s total expenditure on R&D workers’ PAYE and National Insurance contributions. If it is, the exceeding amount is carried over to any Expenditure Credit for the next accounting period.

The remaining R&D Expenditure Credit amount pays for outstanding Corporation Tax liabilities for any past accounting periods.

If your company is a member of a group, the R&D Expenditure Credit can be surrendered in whole or part to another group member.

R&D Expenditure Credit can be used to discharge any other company liabilities. For example, VAT or contract settlement liabilities.

The final remaining R&D Expenditure Credit amount can be paid to your company.

We have several case study examples of businesses that have successfully claimed R&D tax credits, including:

Winch Design: the UK’s leading super yacht and private jet architect.

Real Wireless: an independent wireless advisory firm.

Hyspec Engineering: a precision machining and engineering oil and gas subcontractor.

How will my business receive the R&D Expenditure Credit (RDEC)?

There are two ways you can receive RDEC:

HMRC’s aims to resolve 95% of payable tax credit claims within 40 days of a technical report being submitted; however, in practice, it may take longer to receive RDEC (partly because of the extra complexity that comes from reviewing claims from larger businesses)

HMRC’s aims to resolve 95% of payable tax credit claims within 40 days of a technical report being submitted; however, in practice, it may take longer to receive RDEC (partly because of the extra complexity that comes from reviewing claims from larger businesses)

For large companies or small, our expert team of tax accounting and technical consultants can help you with your RDEC claim.

· How to prepare your additional information for claiming R&D Tax Relief

· Navigating the 2023 changes to R&D Expenditure Credit (RDEC)

Explore our latest insights

Synthetic biology (or SynBio) is an exciting intersection of biology and engineering, which promi...

Even in the best of circumstances, we know that it can be challenging to balance a successful car...

Small and Medium-sized enterprises (SMEs)are the lifeblood of innovation in the UK. We’ve dived i...

Full expensing is a first-year allowance that allows businesses to reduce their tax liability and...