Synthetic Biology: market drivers, challenges and R&D oppo...

Synthetic biology (or SynBio) is an exciting intersection of biology and engineering, which promi...

The agriculture, forestry, and fishing industries play a vital role in the UK’s economy. These sectors contribute significantly to the country’s GDP, providing jobs, securing our food supply, and supporting rural communities. Research and development (R&D) plays a vital role in these industries’ advancement, addressing both economic and environmental challenges. In agriculture, R&D paves the way for innovative farming techniques, and crop yield improvements. It also aids in the development of sustainable farming practices and the enhancement of animal welfare. In forestry, R&D is vital in exploring sustainable timber harvesting methods, forest conservation strategies, and combating climate change. The fishing industry also relies on R&D for sustainable fishing methods, species preservation, and improving fishing technology.

Currently, the UK Government is aiming to drive further innovation through grants such as the Seafood Innovation Fund and the various Farming Innovation grants, which aim to fund R&D projects that benefit farmers, growers and foresters.

This article examines the most recent government data on R&D Tax Credit Statistics, to review the health of R&D expenditure in the Agriculture, Forestry, and Fishingindustries.

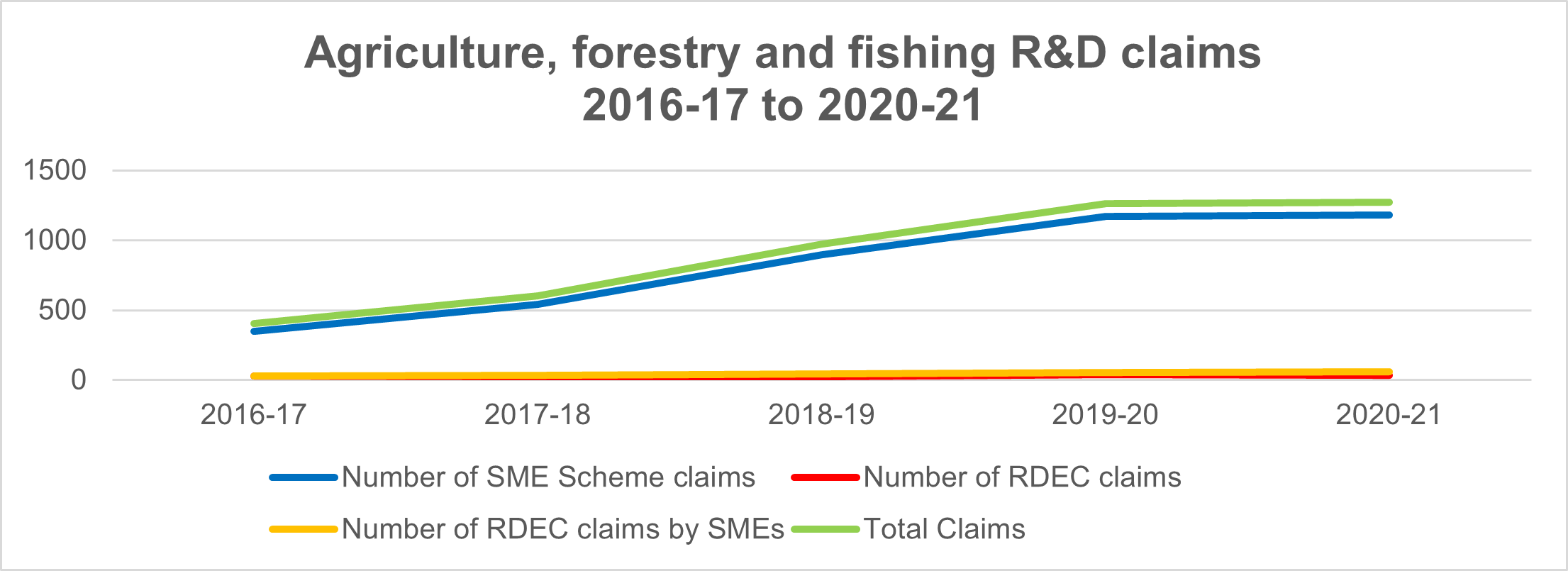

After a strong period for R&D claims, particularly from 2017-18 to 2019-20, growth during the 2021-21 tax year noticeably slowed. From 2018-19 to 2019-20, the total number of R&D claims from the agriculture, forestry, and fishing industries grew by 30% from 975 to 1,265. From 2019-20 to 2020-21 this growth slowed to just 1% from 1,265 to 1,275 claims. This breaks down to 1,180 claims through the SME R&D scheme, 35 RDEC claims from large organisations and 60 RDEC claims from SMEs.

While there has been an apparent slowdown in growth in the agriculture, forestry, and fishing industries, it’s worth noting that on average R&D claims declined for most industries during the COVID-19 pandemic period.

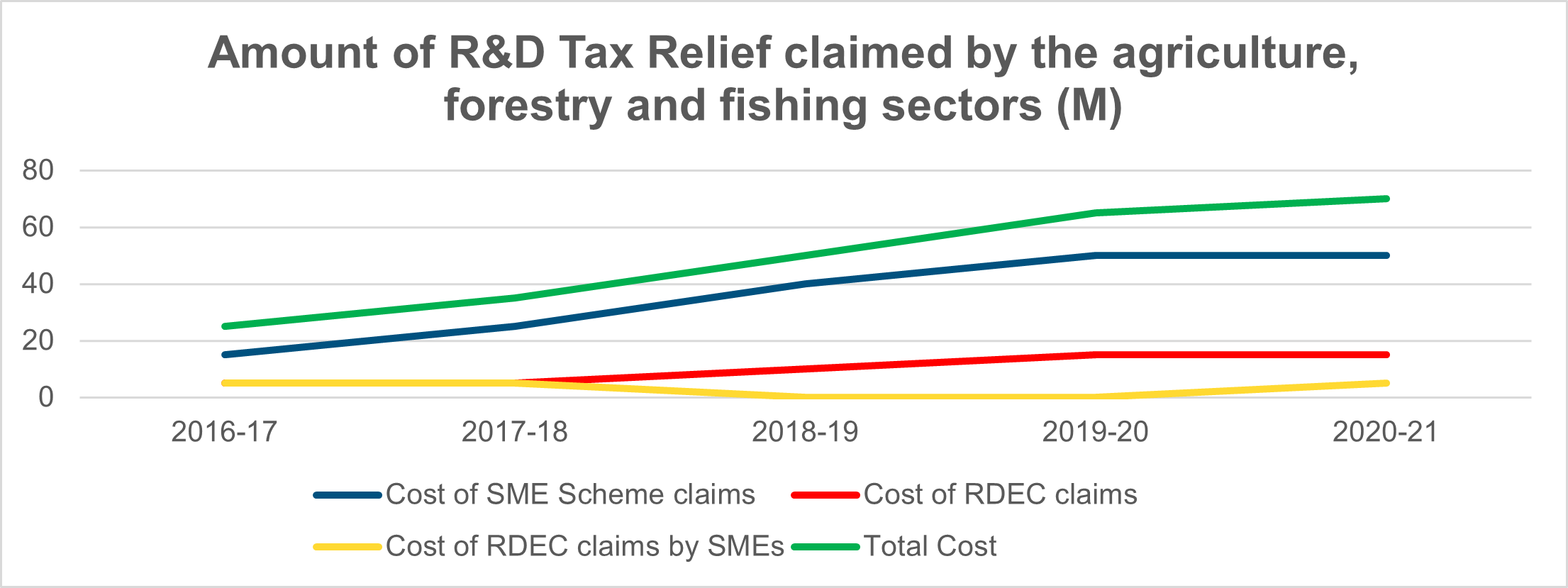

The amount of R&D cash relief claimed by agriculture, forestry, and fishing businesses had steadily risen for the last few years but grew only slightly during the 2020–21 tax year, from 65 million to 70 million, which is 8% growth. Again, agriculture, forestry, and fishing fared better than most other industries as overall there was an average 12% year-on-year decrease in R&D Tax Credits claimed.

The amount of relief claimed through the SME scheme and RDEC was the same for the agriculture, forestry, and fishing sectors – £50 million claimed through both the SME scheme in both 2019-20 and 2020-21 and £15 million claimed from RDEC claims in both 2019-20 and 2020-21. This means that the slight growth of £5 million claimed came from SMEs claiming through the RDEC scheme.

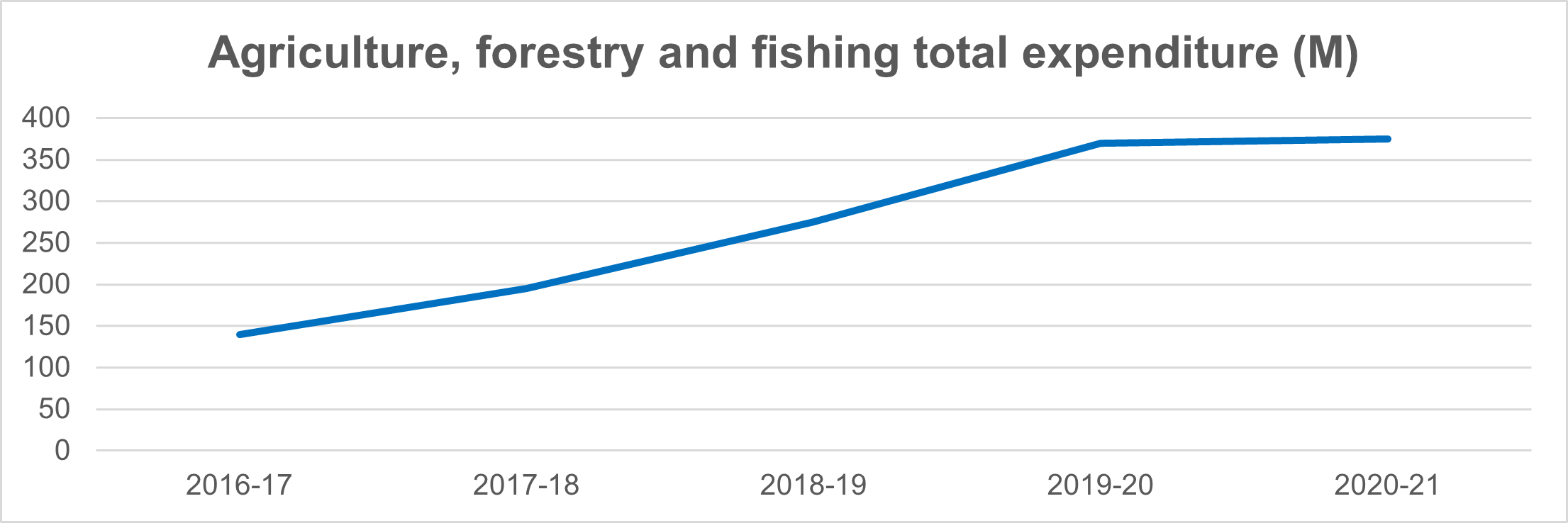

R&D expenditure in agriculture, forestry, and fishing grew by just 1%, from £370 million in 2019-20 to £375 million in 2020-21. Again, this growth was relatively stronger the most other sectors in the UK as average R&D expenditure in the UK declined by 11% in the 2020-21 tax year.

In 2022, the agriculture, forestry, and fishing sectors collectively accounted for approximately 0.7 of the total UK economic output.

In 2021, the agriculture industry contributed around £11.22 billion to the UK economy. As of 2022, the industry employs 301,000 workers. Forestry, though smaller in scale, made a significant contribution as well. As per the latest data from Forrest Research, it added £0.74 billion to the UK economy and employed 19,000 people.

The fishing industry, according to the UK Government’s UK Fisheries Statistics, generated an economic output of £0.48 billion in 2021 and provided employment to 11,000 fishers.

Leyton has helped process over 1,100 agriculture claims, helping businesses receive £50 million in R&D Tax Credits. Agriculture, forestry, and fishing companies that use innovative methods to improve efficiency, yields, animal welfare, or land quality are likely eligible for significant cash relief through the R&D Tax Credit scheme. Find out how we’ve helped the agricultural sector claim R&D Tax Relief.

If you enjoyed this article, you might also like:

Explore our latest insights

Synthetic biology (or SynBio) is an exciting intersection of biology and engineering, which promi...

Even in the best of circumstances, we know that it can be challenging to balance a successful car...

Small and Medium-sized enterprises (SMEs)are the lifeblood of innovation in the UK. We’ve dived i...

Full expensing is a first-year allowance that allows businesses to reduce their tax liability and...