Leveraging the 45L Tax Credit with LIHTC

Overview The Low-Income Housing Tax Credit (LIHTC) was introduced in 1986 and has been by far the...

While there are many real estate tax incentives available on the market, Cost Segregation is still the most valuable. Here’s why.

Cost Segregation is an IRS-approved method of accelerating depreciation by isolating building components into assets. This subsequently changes their depreciation classes, allowing them to be depreciated faster than when grouped with the building.

All too often, property owners treat their buildings as a single asset, leaving this significant incentive on the table.

The179Dand 45L tax incentives reward investments in specific energy-efficient building systems. Cost Segregation is a broader incentive benefitting investment into overall property ownership.

At 27.5 years for residential and 39 years for commercial properties, buildings sit in the longest-lived asset classes in the tax code. These assets take decades to return depreciation deductions. Inappropriately including assets in these classes costs companies hundreds of thousands of dollars in deductions each year.

Cost Segregation makes it possible to capitalize on all incentives available by identifying discreet tax-advantaged assets hidden in building classes.

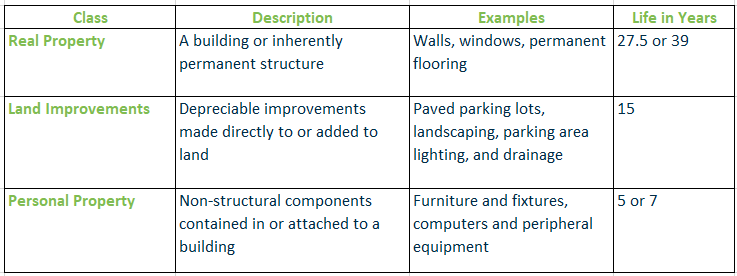

Cost Segregation is a detailed, engineering-based process of methodically separating personal property and land improvements from a building’s structural assets. Classes typically examined in a Cost Segregation study include:

As noted in the table above, through Cost Segregation, Land Improvements can return more than double the deductions, and Personal Property can return up to almost eight times the deductions when correctly depreciated.

In addition to having shorter lives than Real Property, Personal Property and Land Improvements are typically eligible for Bonus Depreciation as well. Bonus Depreciation generally applies to assets with class lives of 20 years and less and allows the owner to deduct up to 100% of their value in the first year.

Many property owners opt to skip the headache of allocating individual assets and place the entire value of a property in the 27.5- or 39-year class life.

While this may appear to be a simpler and seemingly more conservative approach, it is actually incorrect.

The Internal Revenue Code stipulates that Personal Property and Land Improvements must be classified as such. So, while including these items in building classes seems simpler, it is incorrect and recognized as an impermissible accounting method.

A Cost Segregation study can be undertaken to rectify the incorrectly classified assets, unlocking accelerated (and bonus) depreciation deductions.

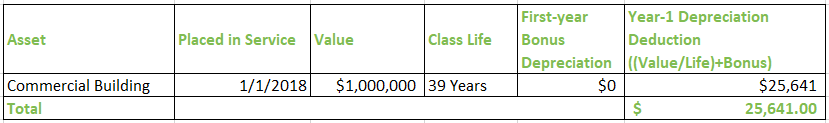

For example:

Before a Cost Segregation study, the entire value of the building above was classified as a 39-year asset generating $25,641 in deductions per year.

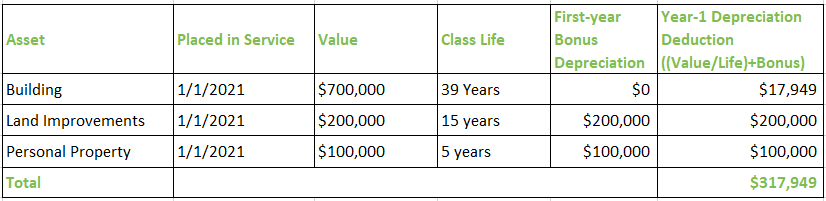

Now consider this:

As a result of the Cost Segregation Study, the building owner was able to access Bonus Depreciation for both the Land Improvement and Personal Property asset classes, correcting their depreciation schedule and returning a $317,949 deduction.

There is no general bright-line test for segregating assets into Personal Property, Land Improvements, and structural classifications. Each situation is factually intensive and is dependent on the circumstances. Leyton’s team of engineers, CPAs, and tax attorneys are trained in techniques to identify individual assets and apply relevant case law to ensure they are appropriately classified.

Explore our latest insights

See more arrow_forward

Overview The Low-Income Housing Tax Credit (LIHTC) was introduced in 1986 and has been by far the...

179D – Energy Efficient Commercial Building Deduction The Internal Revenue Service Section ...

The US R&D Tax Credit has emerged as a game-changer, offering substantial benefits to fuel th...

Overview In the wake of the AI boom, sparked by pioneers like Geoffrey Hinton, Yoshua Bengio, and...