Leveraging the 45L Tax Credit with LIHTC

Overview The Low-Income Housing Tax Credit (LIHTC) was introduced in 1986 and has been by far the...

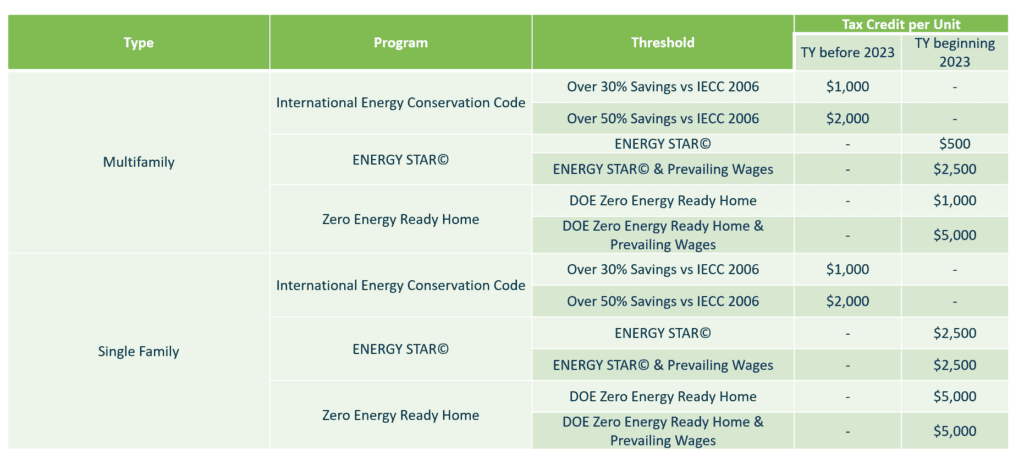

The §45L tax credit was passed by congress as part of the Energy Policy Act of 2005 to incentivize building energy efficient residential properties. Originally, this incentive rewarded builders or developers of single family and multifamily homes with a tax credit of $2,000 per home for meeting certain energy efficiency criteria. However, with the passing of the Inflation Reduction Act of 2022 (IRA), congress extended the §45L tax credit until 2032, and significantly expanded the scope of this incentive.

For multifamily family buildings, the builder/developer can qualify for $500 per unit for meeting Energy Star requirements or $1,000 per unit for meeting ZERH specifications, unless they meet prevailing wage requirements, in which case, they qualify for the full $2,500 and $5,000 respectively.

If you have built or developed and sold or leased any homes before 2023 then you most likely would qualify for the §45L tax credit.

If a developer or builder plans on building to Energy Star or Zero Energy Ready Homes standards for any projects starting in 2023, then they are likely to qualify for this incentive.

With a staff of Professional Engineers, HERS raters, and CPA’s and tax experts we are the all-in-one §45L. Whether a developer is trying to get the most out of their existing project or looking to offset the costs of a new build, Leyton has the expertise to assist with determining eligibility for and maximizing tax credit and incentives geared towards commercial real estate project.

Explore our latest insights

See more arrow_forward

Overview The Low-Income Housing Tax Credit (LIHTC) was introduced in 1986 and has been by far the...

179D – Energy Efficient Commercial Building Deduction The Internal Revenue Service Section ...

The US R&D Tax Credit has emerged as a game-changer, offering substantial benefits to fuel th...

Overview In the wake of the AI boom, sparked by pioneers like Geoffrey Hinton, Yoshua Bengio, and...