How artificial intelligence innovators can benefit from R&...

Explore how AI innovators in the UK can overcome R&D challenges and boost innovation through ...

Many people associate R&D projects with work carried out using test tubes in laboratories, conducted by people wearing long white coats. But R&D isn’t limited to just lab work. It takes place in offices and factories (or even in your employees’ homes if you offer remote working!).

Research and development naturally occurs when a business develops a new product or creates a unique solution to a real-world problem. However, many companies miss out on claiming R&D Tax Credits – a valuable government incentive that rewards innovation – because they don’t realise that their work qualifies as an R&D project. But if your business has made a scientific or technological advancement (or tried to), then your work might indeed be classed as an R&D project (as defined by BEIS).

In this article, we break down what constitutes an R&D project, helping you determine if your innovative work can is eligible for R&D Tax Relief.

R&D relief is designed to incentivise planned research and development, so you can only claim if your discovery has come about as the result of a planned project. In other words, if your project involves routine work that’s part of your regular commercial operation then it won’t be eligible for R&D relief.

This doesn’t mean that you have to plan to claim R&D relief from the outset. Having a project plan simply means that you’ll have approached your R&D in a structured way to achieve a specific objective. It’s very common for businesses to retrospectively discover that they’re eligible for tax relief for their innovative work, regardless of the circumstances of how the R&D project started.

For example, a business might be forced to develop a technical solution when they’re presented with an obstacle. Or, a client may give a business a complex engineering brief that can’t be fulfilled by using existing methods. In these circumstances it’s normal for a business to put together a plan to develop and test new ways of meeting these challenges – and the result might be that they create something new in the process.

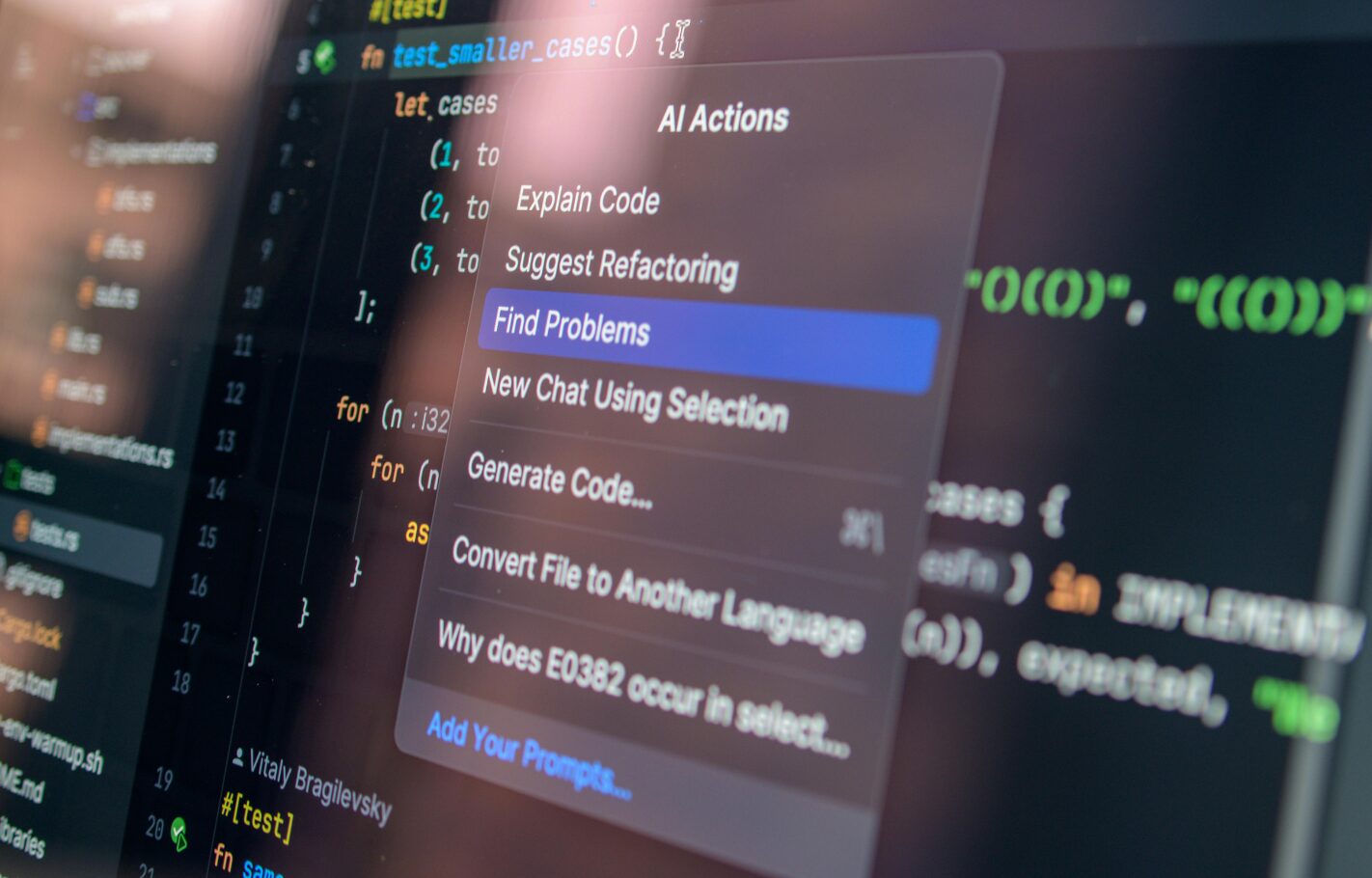

A project will only qualify for R&D relief if it specifically aims to resolve uncertainties in the field of science or technology. In practice, a huge range of sectors can apply from architecture and construction all the way to engineering biology and artificial intelligence.

R&D projects must aim to deliver an ‘advance’, which is another way of saying that your work must drive the creation of new materials, processes, products, or services or improve existing ones. Your advance must improve our overall knowledge – it can’t just be an advance for your business. Your advance also can’t be readily obvious or easily worked out by someone with expertise in the field.

Furthermore, the advance can’t just be a gradual improvement that’s occurred over time through tweaks and optimisations. If an advance has been arrived at outside of a project framework or without a particular goal in mind, then it wouldn’t be considered part of an R&D project.

R&D projects must address scientific or technological uncertainties. For those uncertainties to exist, there must be a knowledge gap or problem that can’t easily be solved by using existing methods or information.

So, before embarking on an R&D project, try to establish a solid understanding of the current scientific or technological knowledge and practices in your field. This baseline can serve as a foundation for your research by helping you to identify the specific gaps or uncertainties that your project aims to address.

Not only will this help you with your work, it will also enable you to explain and justify how your project goes beyond existing knowledge and contributes to advancements in science or technology.

When there is a scientific or technological uncertainty, the only way to move forward is to conduct research and development to try to overcome the uncertainty.

Even projects that don’t ultimately overcome the uncertainty can still qualify for R&D relief. As long as there was a genuine attempt to overcome uncertainty and advance scientific or technological knowledge, the costs associated with that effort might still be eligible.

A qualifying R&D project will be made up of activities aimed at achieving an advance in science or technology. You’ll need to have records of each of these activities, which may also include sub-projects (as long as they’re aiming to tackle your identified uncertainty by creating an advancement).

Your records should include information such as what was involved, who worked on the projects, what materials were consumed, expenditure records, etc.

Your records should also include details of the start and end dates of the R&D activities. Generally, a project starts when active work begins to resolve a scientific or technological uncertainty and ends when that uncertainty is resolved or when work towards a solution ceases. In other words, preliminary work such as brainstorming and project-scoping wouldn’t be considered part of your project, and your project would typically end when you’ve arrived at a usable solution or functional prototype.

We’ll help you to claim R&D Tax Credits for your innovative projects.

By speaking to your engineers and technical team, we’ll identify qualifying activities and prepare a comprehensive technical report that will allow you to claim valuable tax relief.

Speak to one of our experts to find out more.

If you enjoyed this article, you might also like:

Explore our latest insights

Explore how AI innovators in the UK can overcome R&D challenges and boost innovation through ...

How to Turn Carbon Reporting and Compliance into a Competitive Business Advantage

Leveraging Capital Allowances to strengthen business resilience and reduce tax

Business Grants for R&D Projects | Funding Opportunities Explained