Supporting working mums at Leyton UK

Even in the best of circumstances, we know that it can be challenging to balance a successful car...

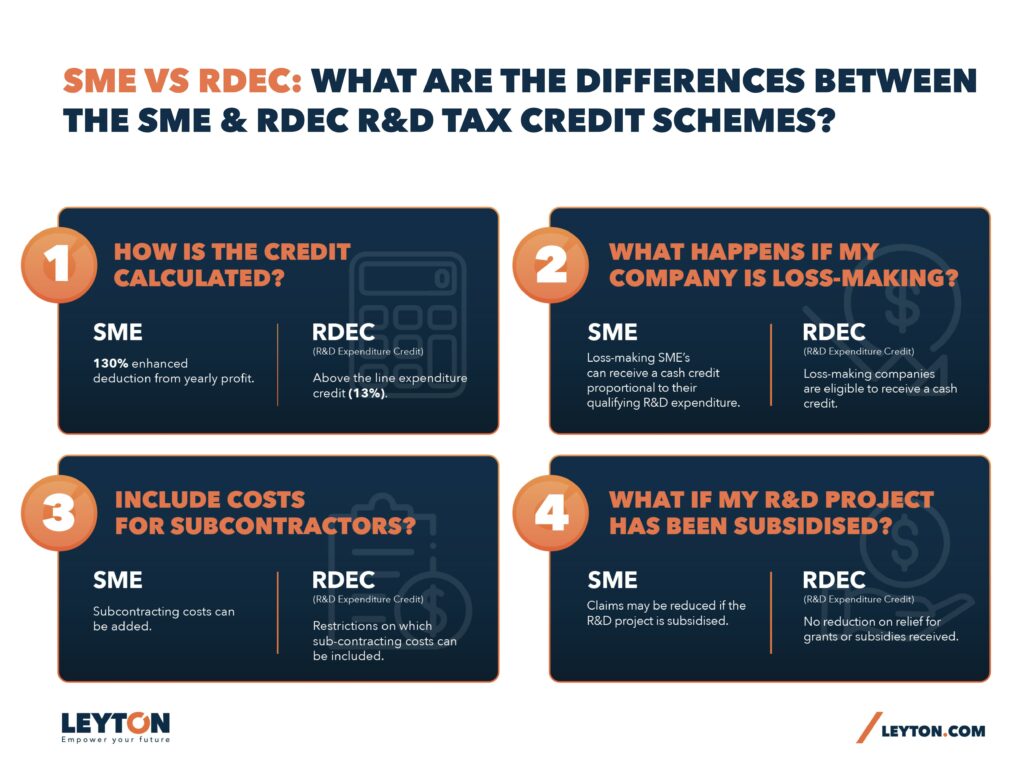

This article highlights the differences between the SME and RDEC research and development (R&D) tax credit schemes. It will be helpful for businesses who are unsure of which R&D tax scheme they qualify for and for those considering transitioning from SME to large company status.

There are two types of corporation tax research and development (R&D) relief: Small and medium-sized enterprises (SME) R&D Relief and R&D expenditure credit (RDEC).

Both schemes are a form of corporation tax relief for R&D expenditure. They each offer financial support to companies conducting R&D activity by making scientific or technological advances by developing new (or updating existing products, processes or services). To qualify for either scheme, you must meet the UK government’s definition of R&D. You can learn more about R&D by reading our blog on R&D Explained: Everything Businesses Need To Know About Research and Development.

To qualify for the SME R&D scheme, a business needs:

< 500 employees

< €100m turnover or €86m net assets

If your SME is part of a wider group, you will need to consider the size of the whole group as these thresholds will apply to all partner and linked entities and not just your individual company.

While RDEC replaced the large company scheme, the difference between SME vs RDEC isn’t as simple as whether or not you’re a small or medium-sized enterprise vs being a large company; some SME’s might still claim corporation tax relief through RDEC. For example, it is possible for some SMEs operating with subsidies or grants to claim relief under the RDEC scheme.

If you change from an SME to a large company (or vice versa), then your tax credit benefit will change (we have outlined the differences between the two schemes in the sections below).

A ‘transition period’ allows companies to preserve their status as either an SME or a large company. If your company just goes over or under the staff of financial thresholds for one year and then falls back down, you probably won’t need to change your status from SME to large company (or vice versa).

For example, if your company has 470 employees in year one, 515 employees in year two, and 480 employees in year three, you won’t need to change status. If you’re over the 500-employee threshold for two consecutive years, you would need to change your status to a large company. Similarly, if you had a turnover of €85 million in year one, €104 million in year two and €90 million in year three, you would not need to change status from an SME. If you exceed a turnover of €100 million for two consecutive years, you’d need to be classed as a large company

The transition period is only applicable if organic growth has taken place; it will not apply if an SME’s status has changed through an acquisition, merger or linking.

No. The SME scheme reduces the corporation tax bill for profitable companies, whereas the benefit received from RDEC comes as an “above the line” expenditure credit.

For pre-April 2023 expenditure

SMEs make an ‘enhanced deduction’, where they can deduct an extra 130% of R&D costs from annual profit. For RDEC claims, the credit itself is taxable income and reduces your corporation tax liability, which can be paid as a cash credit. Expenditure credits are calculated at 13% of R&D expenditure.

For post-April 2023 expenditure

The ‘enhanced deduction’ for SMEs will decrease from 130% to 86% and the SME credit rate will reduce from 14.5% to 10% except for loss-making SMEs that are R&D intensive (where their R&D spend is at least 40% of their total spend). The RDEC rate will increase from 13% to 20%.

Loss-making SME’s can receive a credit proportional to their qualifying research and development expenditure. The tax credit is worth up to 10% of the surrenderable loss, unless your company is R&D intensive; if a loss-making SME’s qualifying spend is at least 40% of their total spend, they will be classed as R&D intensive and can therefore claim a higher credit rate of 14.5%. If you wish, you can carry losses backwards or forwards into previous or future claim periods. You might carry losses backwards if you made a profit in a previous year, or forwards to offset losses against profits in a future period.

The RDEC scheme allows loss-making companies to receive a credit worth up to 13% of qualifying R&D expenditure (rising to 20% for expenditure on or after April 2023). The loss-making credit works in the same way as if the company was profitable, so the credit is also treated as taxable income

All subcontracting costs can currently be added under the SME scheme. Although, from April 2024, the UK Government plans to bring in subcontracting restrictions; expenditure for overseas subcontracting and externally provided workers (EPWs) not paid through a UK payroll will generally be excluded.

For the RDEC scheme, there are restrictions on which sub-contracting costs can be included. In fact, it’s generally not allowed unless it is carried out by a UK Government listed R&D qualifying body such as a University or charity, an individual or a partnership where each member is an individual.

The SME scheme may reduce claims if the R&D project is subsidised. For the RDEC scheme, there is no reduction on relief if grants or subsidies have been received.

There are certain circumstances, for example where subsidised expenditure doesn’t exceed the subsidy, that may result in the expenditure qualifying partly for both the SME and RDEC schemes.

HMRC state that its ambition is “to deal with 95% of payable tax credit claims within 28 days of receiving the claim” for SMEs claiming R&D tax credits. Currently, we have seen longer processing times however HMRC are working to reduce claim times back to 28 days.

Claims through the RDEC scheme can take longer to pay due to the greater complexity of larger businesses.

Don’t panic. We have team of highly qualified tax and technical consultants who can answer any questions that you might have. Many of them have hands-on experience across a range of software, science and engineering industries. Their expertise can help you to identify all the areas where you can claim R&D Tax Credits.

Explore our latest insights

Even in the best of circumstances, we know that it can be challenging to balance a successful car...

Small and Medium-sized enterprises (SMEs)are the lifeblood of innovation in the UK. We’ve dived i...

Full expensing is a first-year allowance that allows businesses to reduce their tax liability and...

To help businesses understand if their work qualifies for R&D Tax Relief and to make sure tha...