Digital Innovation in Healthcare: Software R&D & Tax C...

Transforming Healthcare innovation Through Technology The healthcare sector is undergoing a profo...

Do you want to pay less in taxes and have an increased cash flow for your business? If your company is on an extension for its 2020 taxes, it may still be eligible to claim the R&D Tax Credit on its current year tax return. Find out if you are eligible!

If you answered yes to all of these questions, your company may be eligible to include a 2020 R&D Tax Credit claim in its extended tax filing this year. Many companies do not realize that the R&D Tax Credit is available to businesses of all sizes and in many lines of business, not just companies performing research in laboratories. Generally, companies claim less tax benefit than they’re entitled to, or in many cases, don’t claim at all due to lack of understanding about the eligibility of the R&D Tax Credit.

The R&D Tax Credit is a Federal tax incentive that allows companies to reduce income tax liability in the current tax year, and potentially receive a refund for taxes paid in the last three years. In addition to the federal tax credits, many states have enacted similar research tax credit laws.

Companies have up to three years to amend its earlier tax returns to take advantage of the benefits offered through the R&D Tax Credit!

In addition, every state has its own rules and regulations to allow companies to amend its tax returns. Therefore it may not be too late for your company to claim the R&D Tax Credit for some earlier years!

Alternatively, if your company is not able to take advantage of an income tax offset for tax year 2020, it still may be eligible to elect to claim the Payroll Tax Credit of the R&D Tax Credit, which allows Qualifying Small Businesses to reduce their employer FICA payroll tax liability in the current year only.

To be considered a Qualified Small Business, the company must have gross receipts for the tax year of less than $5 million, and no gross receipts for any tax years preceding the five-tax-year period ending with the credit determination tax year. A company making this election for 2020 must not have had any gross receipts in a tax year prior to 2016.

A company that makes the election for the 2020 tax return on its timely filed original tax return (including extension) on April 15, 2021, would be able to use the credit against payroll tax liability for the third quarter of 2021. Any credit that exceeds the payroll liability for that first calendar quarter following the filing of the return is carried over to the succeeding calendar quarter.

Because of the timely filed return requirement, a company will need to determine and report a research credit on its timely filed return (including extension) to elect to use the Payroll Tax Credit.

The Payroll Tax Credit is limited to $250,000 each year for up to five years.

If your company is a Qualified Small Business and is currently on extension, it still has time to elect the Payroll Tax Credit Offset on its 2020 tax return and apply it to offset payroll on its first calendar quarter following the filing of its 2020 tax return.

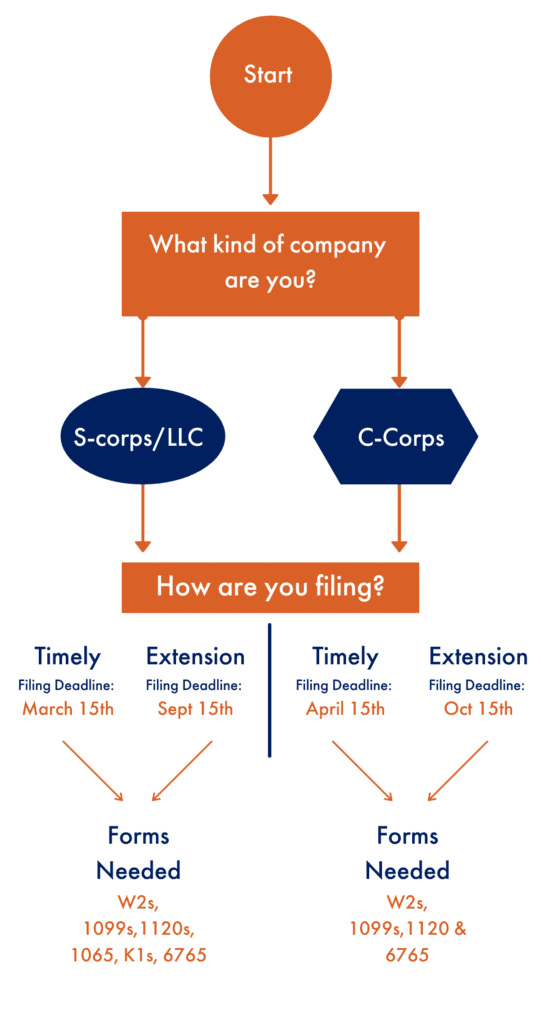

Whether your company is filing for a September 15th or October 15th extension, we can get you engaged for your R&D Study and introduce you to your tax and technical team at Leyton. Our team will work with you to confirm if it indeed makes sense for you to claim the R&D Tax Credit on your 2020 extended tax return and work with you to determine:

Contact us today for a free 30 minute consultation with our tax experts to find out your eligibility to claim the R&D Tax Credit this year!

Founded in 1997, Leyton is a global innovation funding consultancy dedicated to helping our clients improve their business performance. In the US, our specific expertise is in optimization of Federal and State Research & Development (R&D) Tax Credits. As a business, we want to help unleash our clients potential and be a strategic partner in their evolution and growth.

Explore our latest insights

See more arrow_forward

Transforming Healthcare innovation Through Technology The healthcare sector is undergoing a profo...

For more than a decade, the 179D Energy Efficient Commercial Buildings Deduction has been a meani...

In the world of pharmaceuticals and biotechnology, innovation isn’t optional; it’s the foundation...

Sales tax exemption certificates are a common compliance tool businesses use to avoid paying sale...