Inflation Reduction Act’s Impact on 179D: Prevailing Wag...

179D – Energy Efficient Commercial Building Deduction The Internal Revenue Service Section ...

Each state has its own laws and complexities surrounding Sales & Use Tax. Often, these complexities lead to overpayments. In this article we analyze the concept of Sales & Use Tax, its ever-changing nature, and present an example from the state of Texas for how nuances can lead to overpayments.

Although laws regarding Sales & Use Tax can vary from state to state. Sales & Use Tax is generally a transaction tax imposed on retail sales, leases, and rentals of most goods, as well as taxable services. Sales & Use Tax is a significant revenue source for states that impose high percentages on taxable transactions. Currently, there are forty-five states and the District of Columbia that collect statewide sales taxes. Additionally, there are 38 states that have local rates and collections which, in some cases, can exceed state rates.

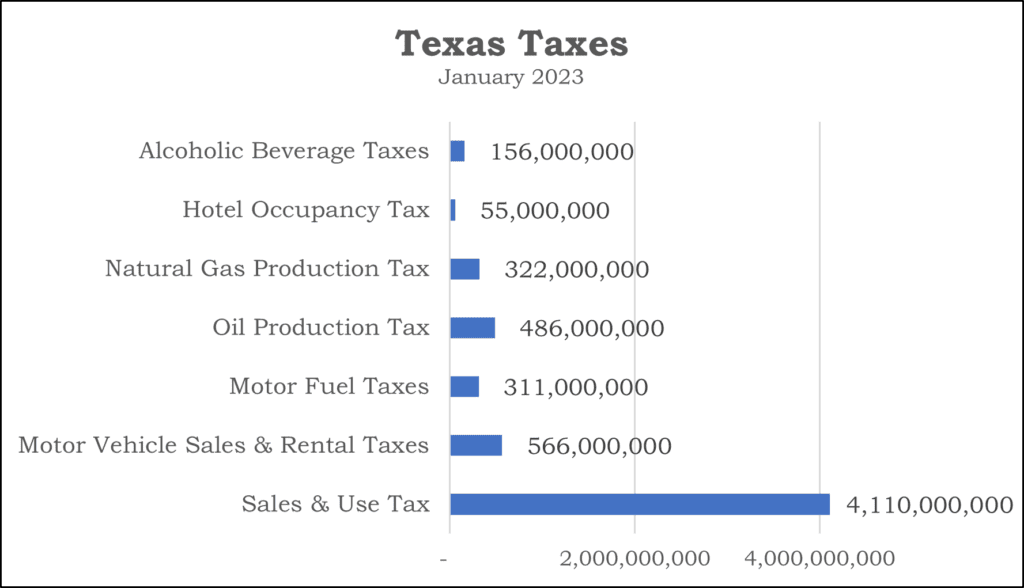

Sales & Use Tax is a revenue generator for states that lack a personal and corporate income tax. Those states seek ways to recoup revenue with a higher Sales & Use Tax rate and the implementation of other miscellaneous taxes (see chart below) in addition to a Corporate Franchise Tax. Texas is one of those states, which imposes a 6.25 percent Sales & Use Tax, while local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) also impose up to a 2 percent Sales & Use Tax for a maximum combined rate of 8.25 percent. In January of 2023, Texas state Sales & Use Tax revenue totaled $4.11 billion. Below is a chart that compares Sales & Use tax revenue in Texas to its other major state taxes:

Since Sales & Use Tax contributes significantly to state revenues, the authorities heavily monitor and audit it. The laws pertaining to taxability of products and services may not always be clear, despite giving high priority to taxation. Additionally, the laws and their interpretations are constantly changing because of case law, advances in technology, macro & micro economic trends, federal policy changes, etc.

At present, there are several bills making their way through Texas’s 88th legislative session, which propose to alter some of the existing or non-existing Sales & Use tax rules. For example:

It is critical for businesses purchasing and consuming taxable items or services in Texas to understand the rules. Companies doing business in Texas should stay on top of these changes to avoid overpaying or underpaying Sales & Use taxes.

There are primarily two avenues for Sales & Use Tax refund and go-forward saving opportunities for businesses: (1) identifying, rectifying, and the ongoing prevention of errors in tax paid or remitted unduly, and (2) the overturn of taxability determinations with the state via a well-constructed appeal.

Here are three areas Sales & Use Tax overpayment are prevalent and can occur in Texas:

Software as a Service (SaaS)

Data processing SaaS generally has 20 percent of its cost exempted from Sales Tax in Texas. It is common for neither the vendor nor the consumer to apply this exemption. For example, if a company is using software in multiple states and allocating the cost proportionally to each state, it is easy to forget to apply the 20 percent exemption for the Texas allocation.

Clerical Errors

Errors can often occur when accounts payable staff accidentally accrue Sales Tax on top of Sales Tax already paid to a vendor. Consequently, this type of error can lead to the remittance of undue tax to the state. Companies in Texas with direct pay permits may issue a certificate to their vendor, relieving the vendor from charging sales tax to them. The responsibility for sales tax rests with the company for remittance of the sales tax. In many cases, the vendor will still charge Sales Tax afterward, and accounts payable may accumulate without the company noticing.

Routine Maintenance on Real Property

Although these services are typically exempt from Sales Tax in Texas, real property repair and remodeling of nonresidential property is not exempt. Vendors or the company’s accounts payable department may overlook these rules. As a result, businesses pay undue sales tax to vendors or accrue and remit sales tax to the state

Sales & Use tax rules require businesses to ensure that they know the law in each state where they conduct operations.

Explore our latest insights

See more arrow_forward

179D – Energy Efficient Commercial Building Deduction The Internal Revenue Service Section ...

The US R&D Tax Credit has emerged as a game-changer, offering substantial benefits to fuel th...

Overview In the wake of the AI boom, sparked by pioneers like Geoffrey Hinton, Yoshua Bengio, and...

Overview Energy Star Certification for homes was established in 1996. With changes to the 45L tax...