Leyton Helps Secure a €91.6 Million Grant for Eavor’s Ne...

We’re proud to announce that the Leyton Group was able to help secure a groundbreaking €91.6 mill...

Edmonton’s new property tax subclass has taken center stage as part of a comprehensive strategy to rejuvenate neighborhoods, address problem properties, and infuse new life into the community.

Edmonton’s new property tax subclass aims to hold property owners accountable for derelict properties.

A derelict property is defined as a property showing signs of serious neglect, significant disrepair, or inhabitable conditions. It also includes properties abandoned during the construction or demolition process.

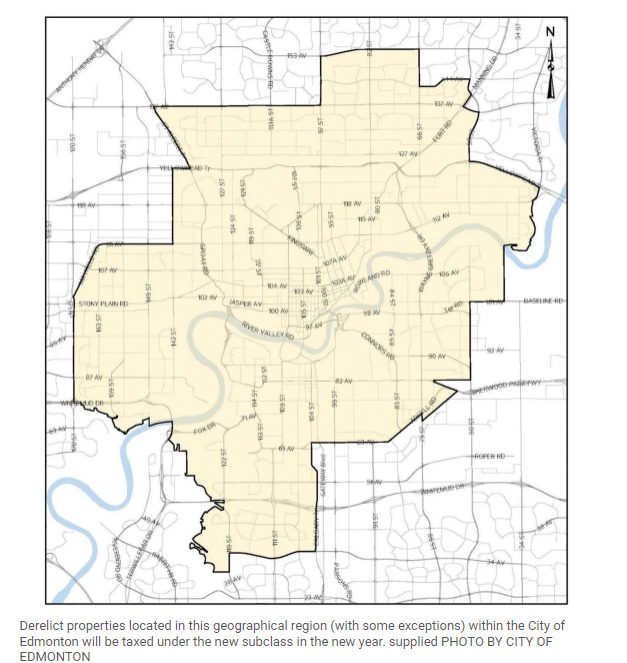

Properties falling under this subclass will primarily be located within the mature neighborhoods overlay area.

Beginning in January of the upcoming year, properties located in “mature residential areas” that meet the criteria for dereliction as of December 31 will receive a notification outlining the specifics of this new property tax subclass and its potential financial implications. Prior to this, initial “visual assessments” of residential properties will have been carried out, with assessors conducting a follow-up inspection in December based on the physical condition of these properties.

As of August 31, 274 properties have been identified as derelict and levied a total of $699,151 in municipal taxes in 2023.

If you’re property meets the classification you could face serious changes in your property taxes. Meet with a consultant today to discuss how you can reduce your property taxes.

Source:

Explore our latest insights

More arrow_forward

We’re proud to announce that the Leyton Group was able to help secure a groundbreaking €91.6 mill...

Just Announced - Alberta property tax increases for 2024 for both Edmonton and Calgary. Both citi...

For property owners and those looking to invest in real estate, staying informed about these chan...

How will Trudeau's recently announced GST Rebate on rental property affect current property owner...