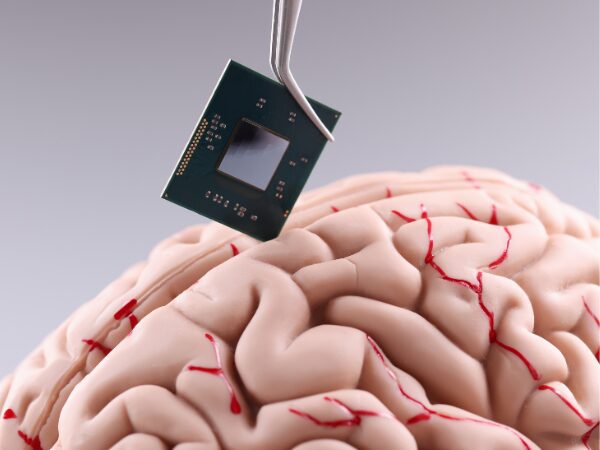

The Role of Brain-Implanted Chips in the Future

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

We often hear how important filing patents is for protecting innovation. However, in addition to patents, there is another program that encourages Canadian companies to further their innovative projects through tax incentives via the Scientific Research and Experimental Development (SR&ED) program. Here’s what you need to know about patents and SR&ED:

Innovation is a driving force for economic growth, competitiveness, and problem-solving and it is at the heart of continued success of a company. Innovative ideas could be protected through legal documents known as patents. Patents are filed with a government patent office to seek exclusive rights to an invention; and are used to protect intellectual property by preventing others from making, using, or selling the patented technology for a specified period (typically 20 years).

The Scientific Research and Experimental Development Program – Commonly known by its acronym (SR&ED), provides tax incentives for research and development (R&D) activities that yield technological advancements.

Patent and SR&ED filings often require experts to assist companies as the process for both filings are typically complicated and time-consuming. Patent applications – In order to be granted a patent, the application must meet the eligibility requirements set forth by the patent office (e.g., USPTO, CIPO) such as novelty, non-obviousness, and

utility of an invention. Patent applications require detailed documentation describing the invention, including specifications, claims, and drawings which would involve both legal and technical aspects. Typically, the patent application could take over 2 years from filing to grant of the patent. Once the patent is granted, exclusive rights are awarded to the inventor for a fixed duration, usually 20 years from the date of filing.

SR&ED applications – SR&ED submissions, on the other hand, is filed with the Canadian Revenue Agency (CRA) to claim back tax credits for R&D activities conducted within a company’s fiscal year. Eligibility requirements to get the tax incentives include: the work must be conducted for the advancement of scientific knowledge or for the purpose of achieving a technological advancement and that the work must be systematic investigation or search that is carried out in a field of science or technology by means of experiment or analysis.

Although patents and SR&ED are two distinct concepts, by leveraging patents and SR&ED incentives together, businesses can maximize the value of their innovation efforts and maintain a strong position in the global market. The following strategies are recommended for pursuing patent and SR&ED applications together:

When filing patents and SR&ED claims, it is important to note that effective documentation, expert guidance, and strategic planning are critical to maximize the benefits of the distinct programs. By taking into account both patents and SR&ED into the R&D efforts of a company, businesses can build a robust intellectual property portfolio that strengthens their competitive position and drives innovation-driven

growth for the organization.

If you are hoping to apply for patents or SR&ED, at Leyton, our experts can help you develop a compelling application without disrupting your day to day activities. Schedule a free consultation with one of our consultants now!

Sources:

https://www.canada.ca/en/revenue-agency/services/scientific-research-experimental-development-tax-incentive-program/sred-eligibility.html

https://www.wipo.int/patents/en/

https://canadianinnovators.medium.com/modernizing-sr-ed-to-cover-patent-costs-is-long-overdue-206b5add341b2 / 277%

Explore our latest insights

More arrow_forward

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Writing a grant proposal is a difficult task for business owners but it is a task that should not...

The new clean investment tax credits have the potential to make a significant impact on Canadian ...

What's next in the world of business funding? We've analyzed the data and discovered the emergenc...