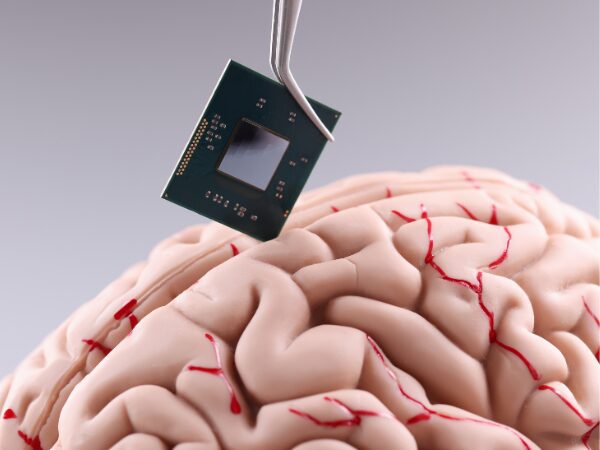

The Role of Brain-Implanted Chips in the Future

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

If you own property, you have to pay property taxes. Whether you own residential, commercial, or industrial property, you have to pay. Commercial and industrial property owners are especially aware, based on the affect taxes have on their bottom line. (see the chart below)

Regardless of where you live in Canada, you have to pay property taxes. In every province, the same formula applies. Your taxes are based on the estimated “assessed” value for your property multiplied by the appropriate tax rate applied by the municipality you live in. Tax rates differ from one city to another, but be assured, the city will find you and tax you!

Depending on which province you live in, there is a different “re-assessment” cycle. For instance, Ontario uses a four-year cycle, British Columbia uses a one-year cycle, and Quebec uses a 3-year cycle. Each province has its own legislation and is administered by its own Assessment Act. In Ontario, the Municipal Property Assessment Corporation (MPAC) is the assessing authority and it has more than five million properties to assess.

To illustrate the effect property taxes have on your bottom line, we have prepared the following chart. The taxes shown are not fictitious – the taxes have been calculated using actual tax rates from one of Ontario’s medium to large cities. We have estimated a property value of five million dollars. The figures shown are actual taxes.

At Leyton, we understand the large burden that property taxes create, as demonstrated above. We have professionals ready to assist you to navigate these difficult waters. Our mandate is to try to save you money and we would love the opportunity of working with you in that regard.

In a discussion on February 4, 2021, with a representative of the Municipal Property Assessment Corporation (MPAC), we were advised that there may be further delays with the implementation of the next re-assessment, which is supposed to be January 1, 2022. Apparently, the Ontario Ministry of Finance will not yet fully commit to the re-assessment going ahead as legislated.

Claude Lachance – Property tax consultant

If you want to know more about the assessment of your property, Contact one of our experts today!

Explore our latest insights

More arrow_forward

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Writing a grant proposal is a difficult task for business owners but it is a task that should not...

The new clean investment tax credits have the potential to make a significant impact on Canadian ...

What's next in the world of business funding? We've analyzed the data and discovered the emergenc...