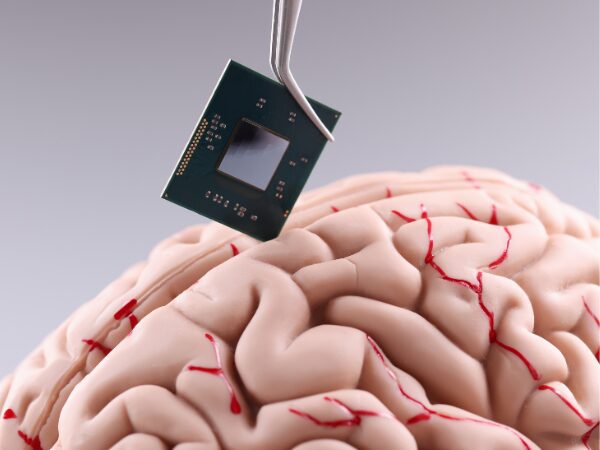

The Role of Brain-Implanted Chips in the Future

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Small and Medium Enterprises (SMEs) are subject to a handful of impediments when it comes to securing financial resources to undertake their general business operation and to fulfill their strategic objectives, cash flow, and investment needs, all of which are crucial to their survival in the long term. Bank lending is the most common source of external finance for most SMEs. Despite the growing role of access to external finance to SMEs, traditional bank finance continues to pose challenges to these enterprises, given their higher risk-return profile.

As a matter of fact, SMEs play a key role in national economies around the world generating employment and value-added while contributing to innovation. According to some researchers, SMEs form the backbone of the private sector, and makeup over 90% of enterprises in the world, and account for 50-60% of employment.

That said, financial barriers put the SMEs at a competitive disadvantage, facing a shortfall in the financing, which and according to the World Bank could hamper the ability of established smaller firms to invest and grow resulting in hindering the overall growth of the economic structure and employment. According to an analytical report published recently, the credit constraints could become “the new normal” for SMEs, it is, therefore, crucial to broaden and diversify the range of financing instruments available to small businesses.

That said, countries are nowadays aware of the great potential SMEs hold, contributing to these businesses’ growth is contributing by creating more jobs, higher wealth, and innovative services/products. Governments today are embarking upon a new mandate, that is of providing subsidies and grants to fund innovative small businesses and fill the gap in the capital market.

In explorative research published recently, it is argued that public financial grant has a direct impact on the strategic and financial management of the business, in the sense that it conditions the company’s value which results in creating more profit. Government financing is proved to be an effective support for business development purposes. Thus, financing operating SMEs has become the focus of attention for several national bodies, which led to several programs being established aiming at supporting entrepreneurs.

The Canadian government recognizes the importance of SMEs in creating a strong economy for all of the nation. To support these businesses, a wide range of programs have been created with different purposes and qualification criteria. There are programs with specific requirements, such as the Northern Business Opportunity Program in Ontario, which specifically states “The proposed new business will operate on a full-time basis and result in job creation in Northern Ontario”; or the Centre of Excellence in Next-generation Networks (CENGN) that solely offers support for businesses involved in technology and innovation.

There are also general grants that are not limited to a given outcome/industry, such as self-employment programs, exporting assistance, training, and hiring, and research and development. These funding programs are positioned to offset business improvement project expenses. These funds can be leveraged to support the small enterprises’ growth and expansion.

Leyton has recently launched a grants search engine, FundScan, that identifies funding streams available for business. FundScan, enables enterprises to discover funding opportunities that match their strategic goals and profile without having to search through separate government websites.

Explore our latest insights

More arrow_forward

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Writing a grant proposal is a difficult task for business owners but it is a task that should not...

The new clean investment tax credits have the potential to make a significant impact on Canadian ...

What's next in the world of business funding? We've analyzed the data and discovered the emergenc...