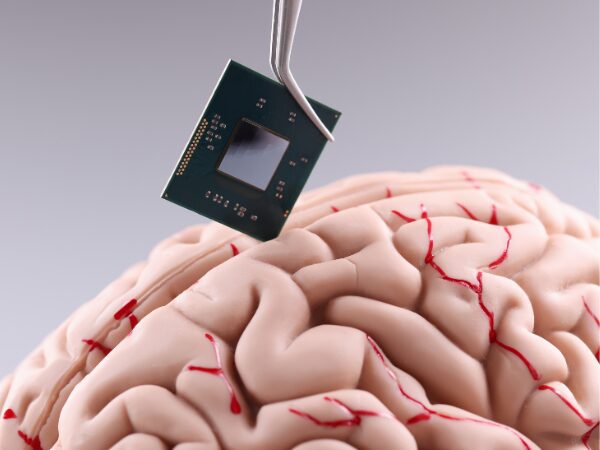

The Role of Brain-Implanted Chips in the Future

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Our Sales Tax Consultant, Caroline Bii, explains everything you need to know about QST (Québec Sales Tax) charged by certain suppliers outside Quebec and certain operators of specified digital platforms.

If you want more information about the QST registration, contact one of our experts today!

Caroline Bii, is a Masters’ Degree holder with over 21 years of work experience. For 13 years, Caroline is a sales tax professional working in the private and public sectors. She carried out recovery audits of GST/HST and QST on large companies in the telecom, manufacturing, and retail sector and GST/HST and QST government audits on companies with revenues of over 200 million.

Explore our latest insights

More arrow_forward

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Writing a grant proposal is a difficult task for business owners but it is a task that should not...

The new clean investment tax credits have the potential to make a significant impact on Canadian ...

What's next in the world of business funding? We've analyzed the data and discovered the emergenc...