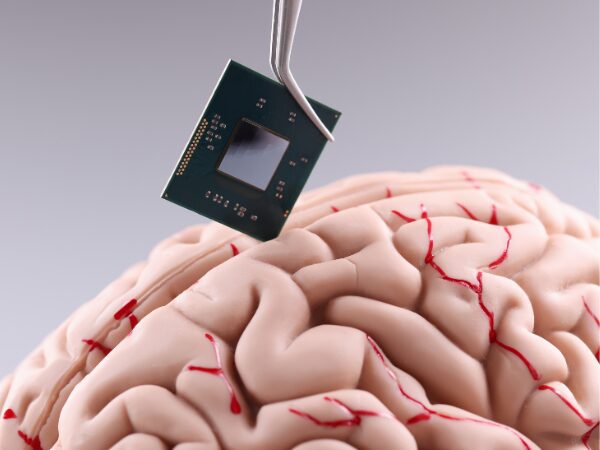

The Role of Brain-Implanted Chips in the Future

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

The introduction of new clean investment tax credits in Canada is poised to impact businesses across various sectors significantly. These credits, aimed at promoting clean energy and technology, promise to support economic growth while fostering environmental sustainability. In this article, we explore the scope and potential effects of these new tax incentives on different types of businesses in Canada.

In the 2023 federal budget, Canada introduced several key tax credits to stimulate investment in clean technology and energy. The most prominent are the Clean Technology Investment Tax Credit, the Clean Hydrogen Investment Tax Credit, and the Clean Electricity Investment Tax Credit. These credits offer refundable benefits, meaning businesses can receive a refund even if they owe no taxes, making them highly attractive for new investments

These tax credits present a valuable opportunity for SMEs to invest in new technologies without bearing the total upfront costs. The refundable nature of the credits ensures that even businesses with lower tax liabilities can benefit. For instance, the Clean Technology Investment Tax Credit covers 30% of eligible new machinery and equipment costs and can significantly reduce capital expenses. This is particularly beneficial for smaller companies looking to modernize their operations or enter the clean technology market, providing reassurance about the support for smaller businesses.

The clean energy sector stands to gain substantially from these new credits. The Clean Electricity Investment Tax Credit, which provides a 15% refundable credit for investments in clean electricity generation and storage technologies, encourages the development of renewable energy projects. This support is crucial for expanding Canada’s clean energy infrastructure, reducing reliance on fossil fuels, and meeting climate targets. Additionally, the Clean Hydrogen Investment Tax Credit offers between 15% and 40% of eligible project costs, promoting the development of hydrogen production facilities that are essential for a sustainable energy future.

Large corporations, especially those in heavy industries such as manufacturing and mining, will also benefit from these incentives. The Clean Technology Manufacturing Tax Credit, covering 30% of costs for machinery used in clean technology manufacturing and critical mineral extraction, will lower the financial barriers to adopting advanced, environmentally friendly technologies. This not only helps reduce the carbon footprint of these industries but also enhances their global competitiveness by aligning with international sustainability standards.

The new tax credits are designed to spur innovation across the Canadian economy. By lowering the investment cost in clean technologies, these incentives encourage businesses to adopt cutting-edge solutions and integrate sustainable practices. This shift is expected to drive technological advancements and improve the overall efficiency of Canadian industries. Moreover, by fostering a domestic market for clean technologies, Canada can position itself as a leader in the global clean economy, attracting international investment and talent and inspiring a sense of pride in the future of Canadian industries.

The investment tax credits also play a crucial role in Canada’s economic recovery post-pandemic. These credits are expected to create numerous job opportunities by stimulating investments in critical sectors. In particular, the clean energy and technology sectors are poised to benefit from increased demand for skilled labor to develop and maintain new projects. This job creation is vital for economic growth and provides a pathway for workers transitioning from traditional industries to emerging green sectors

While the new tax credits offer substantial benefits, there are challenges and potential risks to consider. Businesses must navigate the complexities of eligibility criteria and compliance requirements to leverage these incentives fully. Additionally, the effectiveness of these credits in driving large-scale investments will depend on the clarity of implementation guidelines and the responsiveness of the regulatory framework. There is a risk that if these guidelines are not clear or the regulatory framework is not responsive, businesses may not be able to fully benefit from the credits. Ensuring that businesses of all sizes can access and benefit from these credits will be crucial for their success.

In conclusion, the introduction of new investment tax credits in Canada represents a significant step towards a sustainable and competitive economy. By supporting investments in clean energy and technology, these credits offer substantial benefits to businesses across various sectors. From reducing capital costs for SMEs to enhancing the global competitiveness of large corporations, these incentives are poised to drive innovation, create jobs, and support Canada’s transition to a clean economy. As businesses navigate the opportunities and challenges presented by these new measures, the overall impact on the Canadian economy is expected to be profoundly positive.

If you have questions regarding these new tax credits or would like to know more on how you can benefit from it, schedule a free consultation with one of our experts!

References:

Explore our latest insights

More arrow_forward

Will brain-implanted chips be a norm in the future? In this article we explore the development of...

Writing a grant proposal is a difficult task for business owners but it is a task that should not...

What's next in the world of business funding? We've analyzed the data and discovered the emergenc...

With rising concerns of sustainability, aeroponics presents as a promising method for Canadians i...