Leyton Helps Secure a €91.6 Million Grant for Eavor’s Ne...

We’re proud to announce that the Leyton Group was able to help secure a groundbreaking €91.6 mill...

The economic climate is changing in Quebec and throughout Canada. Will this change impact commercial and industrial property owners and tenants? Here is all you need to know:

Bonus: Don’t forget to download our in-depth analysis below! 👇

Commercial Property: Office Space in Montreal

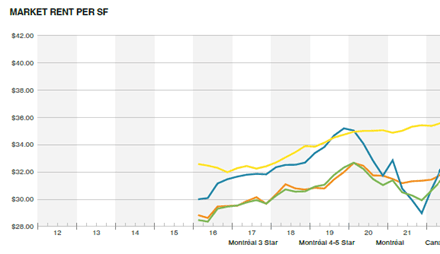

With remote and hybrid working becoming the norm, Montreal’s office sector and economy is facing the repercussions of this trend. Not only is this trend impacting the recovery of Montreal’s office sector, but it is also affecting the overall economy in Montreal. In fact, in 2023, Canada’s economy is expected to enter a recession, according to Oxford Economics, and Montreal’s economy is also expected to shrink.

Consequently, the city of Montreal recently expressed interest in assisting property owners in converting office buildings into housing as a result of the increase in vacant office space related to emerging work trends. Nevertheless, although Montreal’s overall sales velocity in this sector has slowed this year in comparison to 2021, some investors continue to believe in the city’s potential as a tech hub in the long run.

Nonetheless, in the not-too-distant future, Montrealers can expect the leasing environment to continue to be under pressure, particularly given that a significant portion of the 2.4 million square feet of new construction is anticipated to be operational in the upcoming quarters. However, some occupiers are taking advantage of the weak leasing environment to relocate to more prestigious office locations.

Want more detail? Download the full report here 👇

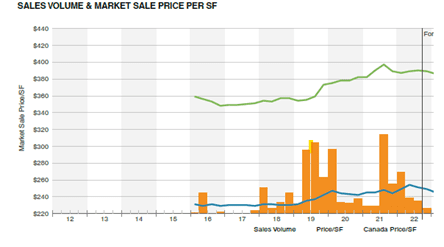

Commercial Property: Office Space Nationwide

According to Environics, workers are returning to the workplace less frequently in Vancouver and Toronto. Notably, mobility to workplaces in downtown Toronto and Vancouver has decreased by as much as 50% compared to January 2020. Canada-wide, the velocity of office demand has also taken a long time to recover. In fact, in Q3 2022, total office sales volumes fell to $1.2 billion, well below their pre-pandemic average. On the other hand, sublease space continues to rise regionally in major tenant markets like Toronto, and it has even slightly increased in Montreal but has continued to decrease in smaller tenant markets like Vancouver.

Industrial Properties in Montreal

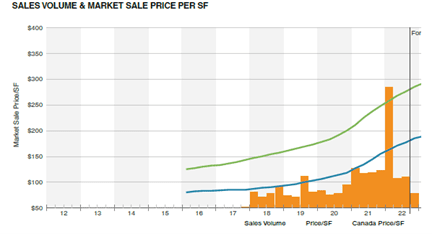

Investors continue to display strong interest in Montreal’s industrial property market due to the high demand and low supply. In fact, In 2022, one in five Canadian industrial sales transactions was in Montreal. Currently, the inventory under construction remains limited and vacancy rates fall around 1.9% for industrial properties; Rents continue to rise in these constrained circumstances (Gross rents exceed $17/SF, and some leased space has gone for more than $20/SF in recent months) maintaining a favourable market for landlords in Montreal in the near future. Interestingly, investors and developers are expressing interest in space off-island for larger facilities.

Want more detail? Download the full report here 👇

Industrial Properties Nationwide

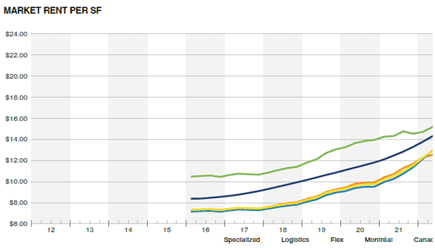

Despite the country’s economic struggle with rapidly increasing inflation, higher interest rates, and the daunting possibility of a recession, Canada’s industrial market remains attractive.

Global supply chain disruptions brought on by the pandemic have been at the heart of the economy’s problem with growing inflation, but signs that these constraints are easing are beginning to appear. Given that there is essentially no vacant industrial space remaining to lease across key markets, the recent progressive easing of supply chain interruptions couldn’t have come at a better moment for Canada’s industrial sector.

Moreover, industrial rent increase is far exceeding price rise in the broader economy, even when compared to the greatest rates of inflation in thirty years. And, despite having higher long-term interest rates in key cities such as Vancouver and Toronto, the industrial cap rate remains very low.

The above-inflation rent growth and very low industrial cap is helping investors to remain allure of the industrial property sector as the economy more widely adapts to higher interest rates.

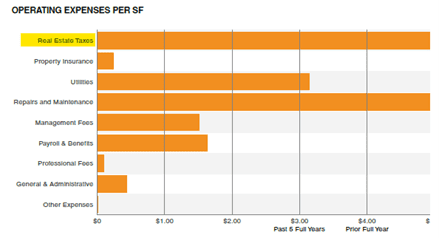

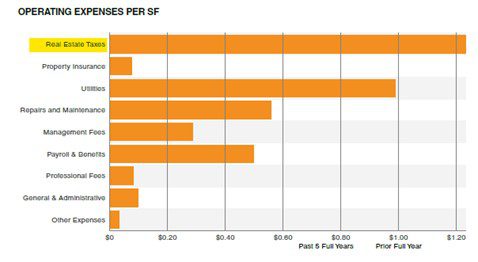

As illustrated above, with the changing economic climate and emerging buying and leasing trends, there are plenty of opportunities for property owners and tenants in Quebec to benefit from a property tax burden evaluation as property tax will continue to remain a large expense.

Managing your property tax can lower the cost of your operational overhead and free up money for reinvestment. Reviewing property tax burden is exceedingly difficult and requires an expert due to ongoing changes in assessment methodology and procedures, such as the ones shown above. The Leyton team has more than 100 years of collective experience in providing property tax and valuation services and is able to help you succeed in this realm. Contact us now to get started!

Explore our latest insights

More arrow_forward

We’re proud to announce that the Leyton Group was able to help secure a groundbreaking €91.6 mill...

Just Announced - Alberta property tax increases for 2024 for both Edmonton and Calgary. Both citi...

For property owners and those looking to invest in real estate, staying informed about these chan...

Just announced: Edmonton introduces a new property tax subclass for derelict properties