Everything businesses need to know about Ireland’s new R&D...

Discover how Ireland’s new R&D Tax Credit and Innovation Compass help businesses boost innova...

Every year, Revenue publishes detailed figures on the performance of R&D Corporation Tax Credits in Ireland. Their Research & Development (“R&D”) Tax Credit Statistics report shows yearly allowable R&D expenditures made by businesses, the value of R&D Credits claimed, and the resulting financial cost to the Irish Government. The current statistics, published in May 2025, cover claims up to and including 2023.

The stats paint a picture of greater investment in research and development, with more companies benefiting from R&D Corporation Tax Credits to support their innovations. 2023 saw a clear rise in the overall number of businesses claiming, which is welcome news, as for the last five years this figure had plateaued. Also notable was a rise in allowable R&D expenditure undertaken by SMEs, as historically growth in this area has been driven by large enterprises.

Of course, what they don’t show us is the current picture, and it remains to be seen how new US tariffs on the EU, as well as other countries around the world, have affected R&D investment in Ireland.

In this article, we’ve dived into the figures to see what they reveal about the overall health of Irish R&D.

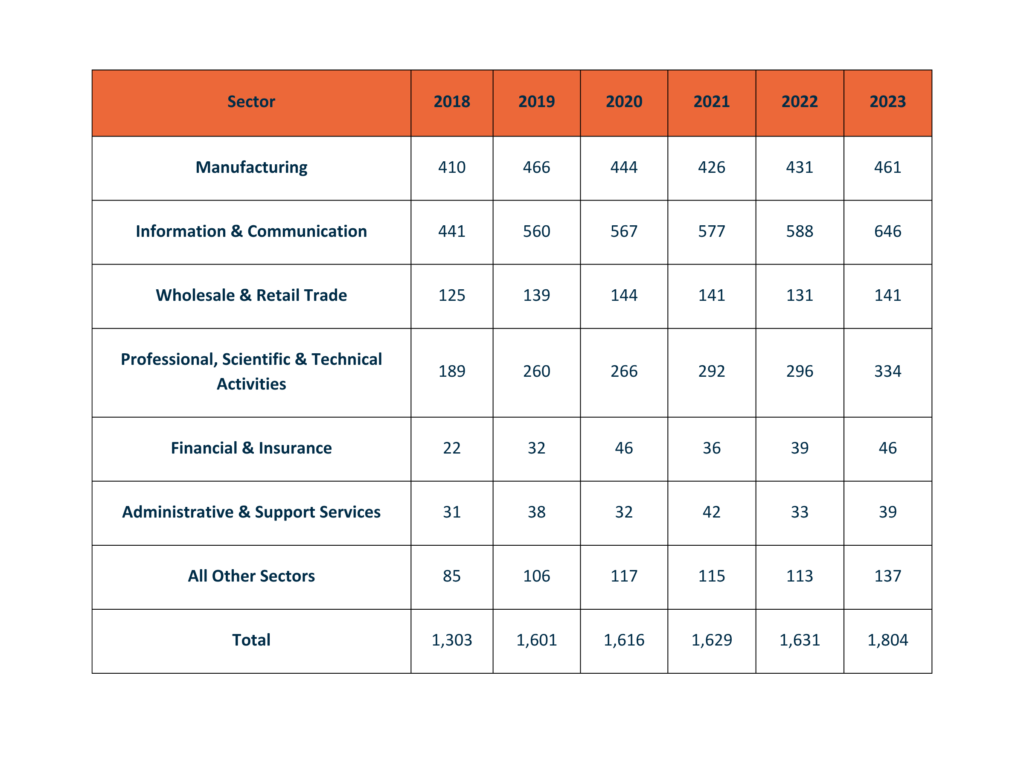

There was little growth in the numbers of companies claiming R&D Credits between 2019 and 2022 (in fact, last year the number increased by just two companies). But in 2023 the number claiming rose by 11%, from 1,631 companies in 2022 to 1,804 in 2023, suggesting growth in the awareness of the scheme.

Every sector experienced year-on-year growth in 2023 in the number of companies claiming – with Information & Communication and Professional, Scientific & Technical Activities all seeing consecutive year-on-year growth since 2018.

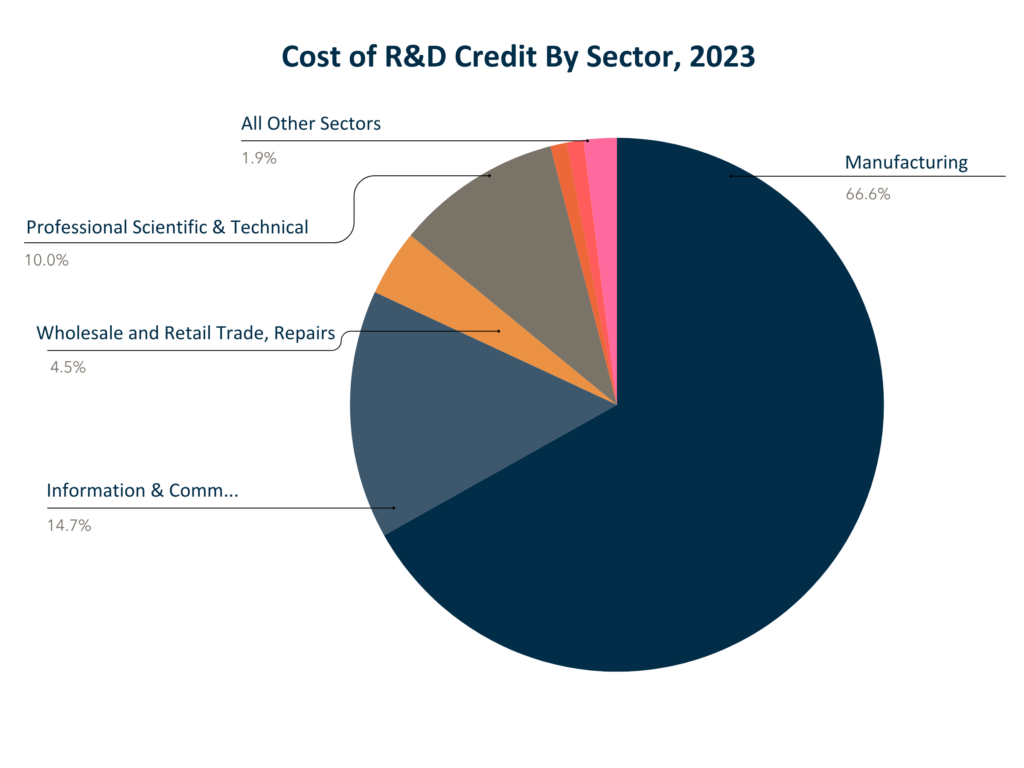

Most claims in 2023 came from companies working in Information & Communication (35.8%), Manufacturing (25.6%) and Professional, Scientific & Technical Activities (18.5%).

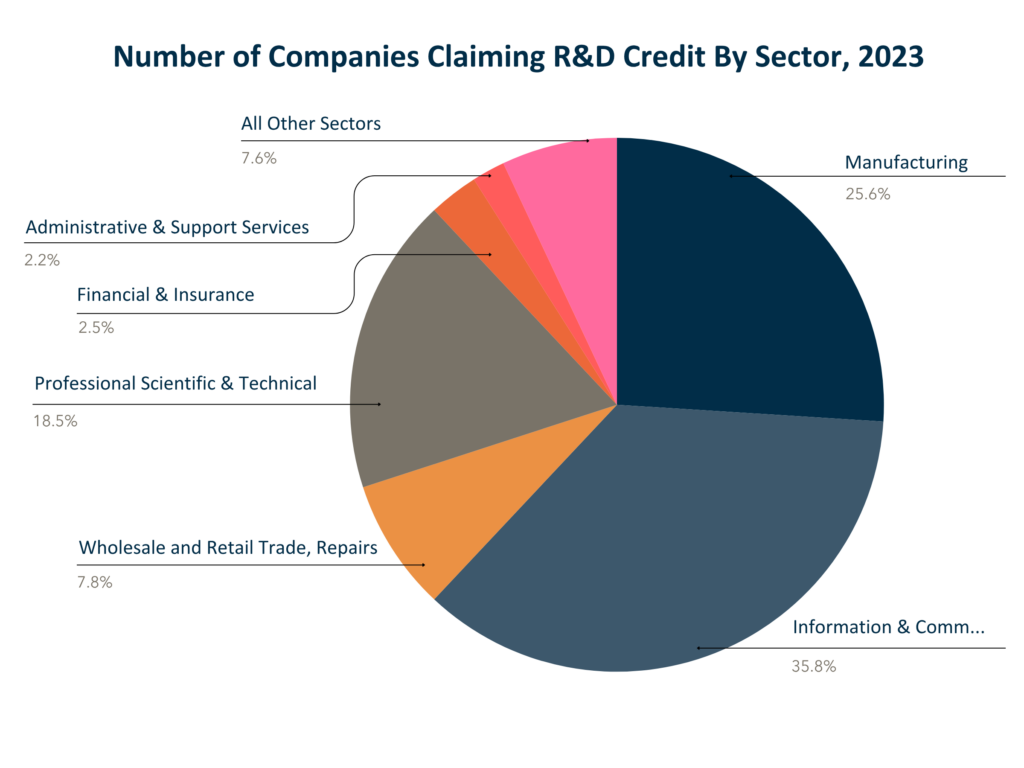

The total cost to the exchequer has risen year-on-year, from €1,158m in 2022 to €1,407m in 2023, a 21.5% increase. Every sector saw some level of increase from 2022 to 2023 except for Wholesale & Retail Trade, which decreased by 38.8% from €103m in 2022 down to €63m in 2023 – the lowest level since 2018.

The Manufacturing sector accounts for most of the cost for R&D Credits, 66.6% – that’s despite making just 25.6% of all claims. The next largest sector is Information & Communication, which costs the exchequer just 14.7% of the total R&D Credit costs, despite accounting for 35.8% of all claims.

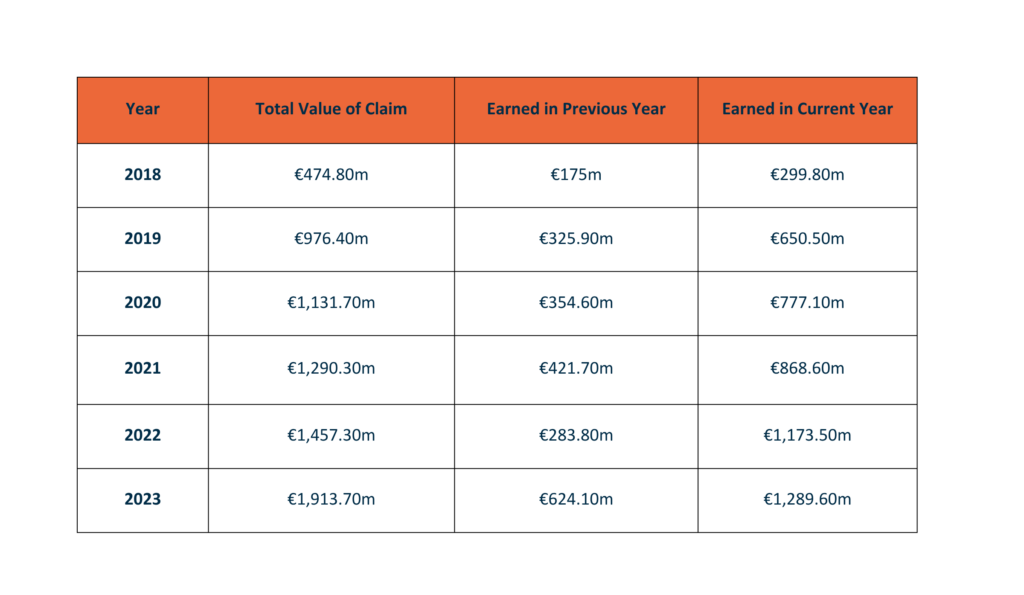

Revenue’s stats for the total amount of R&D Credit claimed are not broken down by sector, but the figures show the rising value of relief for Irish businesses with increases every year. 2023 saw a 31.3% year-on-year rise in the total value of R&D Credit claimed, from €1,457.30m in 2022 to €1,913.70m in 2023.

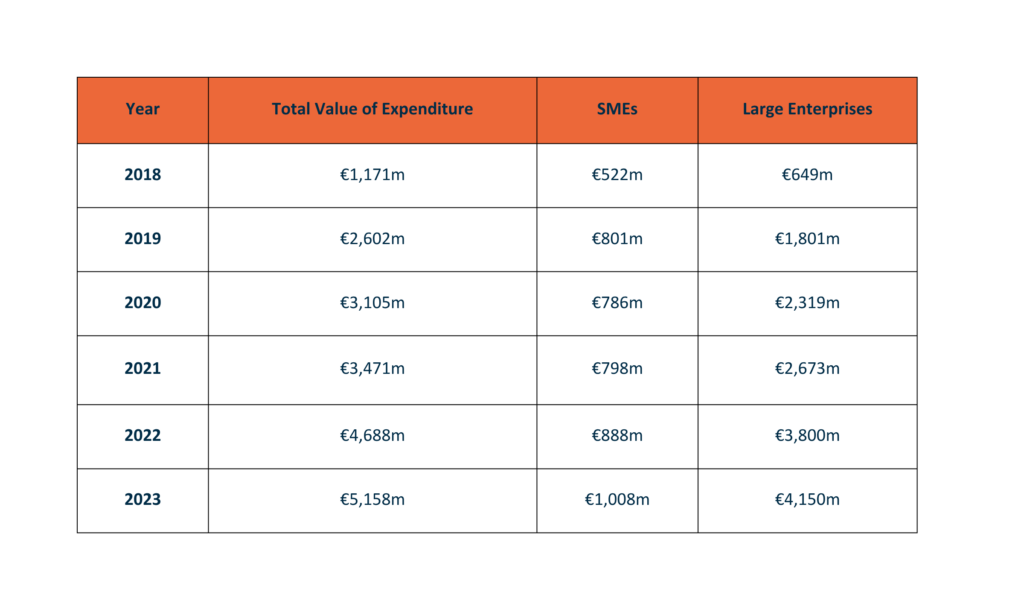

The figures from Revenue show a year-on-year trend of higher R&D expenditure, with increased investment coming from both SMEs and large enterprises. In 2023, the overall total value of expenditure rose by 10% year on year. While positive, this does represent a slowing down of growth in R&D expenditure, as it increased by 35% in 2022.

In previous years, growth in R&D expenditure was consistently driven by large enterprises, but 2023 broke this trend with 13.51% growth in SME expenditure compared to 9% for large enterprises. Despite this, large enterprises still account for 80.5 of all allowable R&D expenditure.

At Leyton Ireland, we help innovative businesses maximise their R&D Corporation Tax Credits claims.

Our team of experts can help to uncover significant savings from claiming relief on eligible expenses from research and development projects.

Get in touch to find out more about how we can help.

Explore our latest insights

Discover how Ireland’s new R&D Tax Credit and Innovation Compass help businesses boost innova...

The Department of Finance’s 2025 review of Ireland’s R&D Tax Credit reveals how the scheme dr...

Get ready for a successful R&D Tax Credit claim in 2026. See why planning ahead and keeping d...

Learn how to calculate Ireland’s R&D Tax Credits for 2025 and 2026, with clear examples, inst...