Summary of Provincial Budgets 2024: Ontario & Quebec

Provincial governments are slowly unveiling their provincial budgets outlining fiscal strategies ...

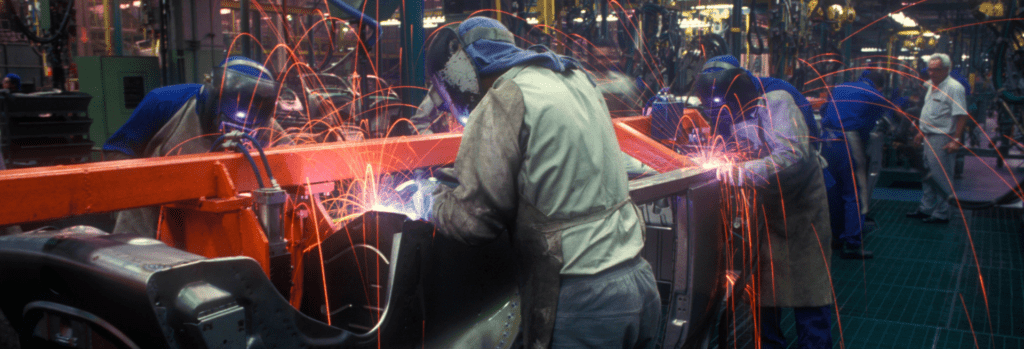

Canada is the eleventh largest automotive producer in the world and the seventh largest auto exporter. In 2020, the industry produced 1.4 million vehicles with exports totaling $42.9 billion, making it one of the largest industry sectors in the country, contributing over $16 billion to the GDP. The industry produces passenger vehicles, trucks and buses, auto parts and systems, truck bodies and trailers, machines, tools and dies and molds (MTDM). As such, the industry employs more than 125,000 people in vehicle assembly and auto parts manufacturing, and another 380,000 in distribution and aftermarket sales and service.

The industry was hard hit by the pandemic as the disruption in Chinese parts exports escalated into large scale manufacturing interruptions worldwide. The pandemic caused factories to close, but this was compounded by a surge in chip demand for mobile devices in anticipation of the roll out of 5G technology. The development in the communication industry boomed, but it negatively impacted chip availability for automotive and industrial applications.

In 2021, the industry experienced some recovery with total sales rising by approximately 7% year-over-year as demand picked up and semiconductor revenue began to grow. But new surges in demand such as those brought about by changing consumer habits, together with challenges in chip capacity allocation have resulted in a global chip shortage in 2021. And, Canadian vehicle production dropped across all segments, despite an increasing demand for cars and trucks.

The demand has continued to grow but there is a shift in the industry with an accelerated demand for new technologies, sustainability policies, and increasing demand for electric vehicles. These forces are giving rise to four disruptive technology-driven trends in the automotive sector:

Consumer preferences are changing and with tightening regulations and new innovative technology, there is a fundamental shift in consumer mobility needs. The society is increasingly using multiple modes of transportation to complete their journey and an increasing number of people rely on ride-sharing and delivery service rather than in-store shopping. As a result, the automotive industry must provide diverse, on-demand mobility solutions to meet consumer needs.

The use of advanced driver-assistance systems (ADAS) is on the rise and will play a crucial role in the automotive industry. Autonomous vehicles will offer tremendous value for consumers (for example, the ability to work while commuting, or the convenience of using social media or watching movies while traveling). It is projected that autonomous cars will account for up to 15% of passenger vehicles sold worldwide in 2030. But the rate of market penetration will be impacted by pricing, consumer understanding, and safety/security issues, so technology players must innovate to address these concerns.

As the industry undergoes these changes, coupled with the increasing speed of innovation, especially in software-based systems, cars will be required to be upgradable. The need for shared mobility solutions with shorter life cycles will become more common as consumers will be constantly aware of technological advances, which will further increase demand for upgradability in privately used cars as well. Additionally, connectivity and autonomous technology will increasingly allow the car to become a platform for drivers and passengers to use their time in transit to consume different forms of media and services or dedicate the freed-up time to other personal activities.

These demands must be paired with sustainable solutions as societal practices change. The transportation sector is responsible for 27 percent of greenhouse gas (GHG) emissions in Canada. Light-duty vehicles – the cars, vans and light-duty trucks we drive – are responsible for almost half of that total. Automakers have made significant advances in some areas, but CO2, the main GHG that impacts climate change is steadily increasing. Given the current technology, this is unavoidable so, since GHG is a by-product of the burning of fossil fuels.

To combat climate change, the government of Canada has launched the “Net-Zero Emissions” by 2050 initiative, with interim goal of 40 percent reduction below 2005 levels by 2030. What this means is that, we are working towards zero GHG emissions by 2050. This initiative is not only directed to the automotive industry, but to all sources of GHG emission, but for this discussion we will focus on the automotive industry since it contributes just over one quarter of all GHG emissions. The government is very aware of this fact and has taken steps to assist Canadians to reach this goal and key measures were released in the 2022 budget.

The measures proposed in Budget 2022 includes:

Budget 2022 and the recently released 2030 Emissions Reduction Plan, are major contributors to Canada’s next steps for clean air and a strong economy. By putting Canadians in the driver’s seat of zero-emission cars and trucks, the government will help people save on gas, while fighting climate change, grow our economy, and build a better future for everyone.

Traditional automotive players are under continuous pressure to reduce costs, improve fuel efficiency, electrify and reduce emissions in the evolving automotive and mobility industries. Vehicles are increasingly integrated into the connected world and automakers will have no choice but to participate in the new mobility ecosystems that emerge as a result of technological and consumer trends. Software developers and OEMs need to align their skills and processes to address new challenges like software-enabled consumer value, cybersecurity, data privacy, and continuous product updates.

Additionally, the automotive ecosystem must quickly address three major constraints before EV production and sales can gain scale:

But there is help, under the Net-Zero Emissions by 2050 initiative, the government has launched several incentive programs to fund projects that contribute to these goals. These include:

At Leyton, we have the expertise to assist all industry players to navigate the changing landscape in a cost efficient way, utilizing many of the government grants and incentives to make your project a reality sooner. The Grants department will walk alongside you throughout the entire process, whether your project is in the R&D stage, looking commercialization, ready to export or expanding market shares.

If you want to know more about our sales tax services, reach out to our experts today.

Sources :

Explore our latest insights

More arrow_forward

Provincial governments are slowly unveiling their provincial budgets outlining fiscal strategies ...

Recently, Canadian representatives attended COP27 to discuss the actionable steps to implement to...

Human-Machine Collaboration has become an essential part of the manufacturing industry. This coll...

Recent announcements demonstrate that the SR&ED program is now under review. The government w...