15% minimum tax for multinational companies and large domestic...

15% minimum tax for multinational companies and large domestic groups. What You Need to Know. Con...

In 2023, companies in the construction and related sectors will still be able to make use (under certain conditions) of the tax measure relating to the partial withholding tax exemption for real estate work in teams on site.

What is the partial withholding tax exemption for real estate work in teams on site?

As of January 1, 2018, certain employers are eligible for a withholding tax exemption on wages awarded to workers who perform real estate work in teams on construction sites. To receive this tax benefit, a company must meet certain cumulative conditions:

It is important to note here that employers can only benefit from this tax measure if all the workers forming a team meet the above basic conditions. If one of the workers does not meet these conditions, the exemption will not apply. There is only one exception to this rule, namely the gross hourly wage condition.

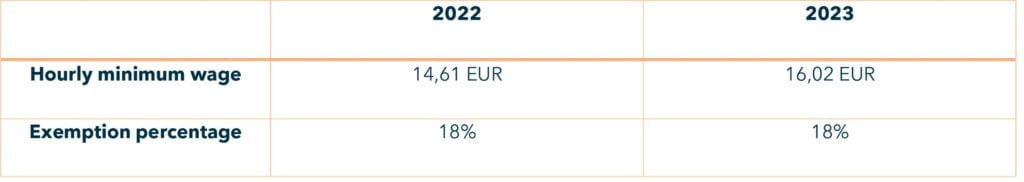

Changement 2023

If you need additional information, please do not hesitate to contact our experts at the following e-mail address: bboeckx@leyton.com.

Reach out to the Leyton experts for more information on our services related to partial withholding tax exemption for real estate work on site.

Explore our latest insights

15% minimum tax for multinational companies and large domestic groups. What You Need to Know. Con...

Don't miss out on valuable tax advantages! Discover how to benefit from increased investment dedu...

In this article, we will provide you with a comprehensive overview of the co-funding opportunitie...

Leyton has ample experience with R&D grant writing. Based on this experience, Leyton identifi...